Budget hearing: Teacher demands to know how much CPS lost in speculative investments in derivatives between early 2008 and today

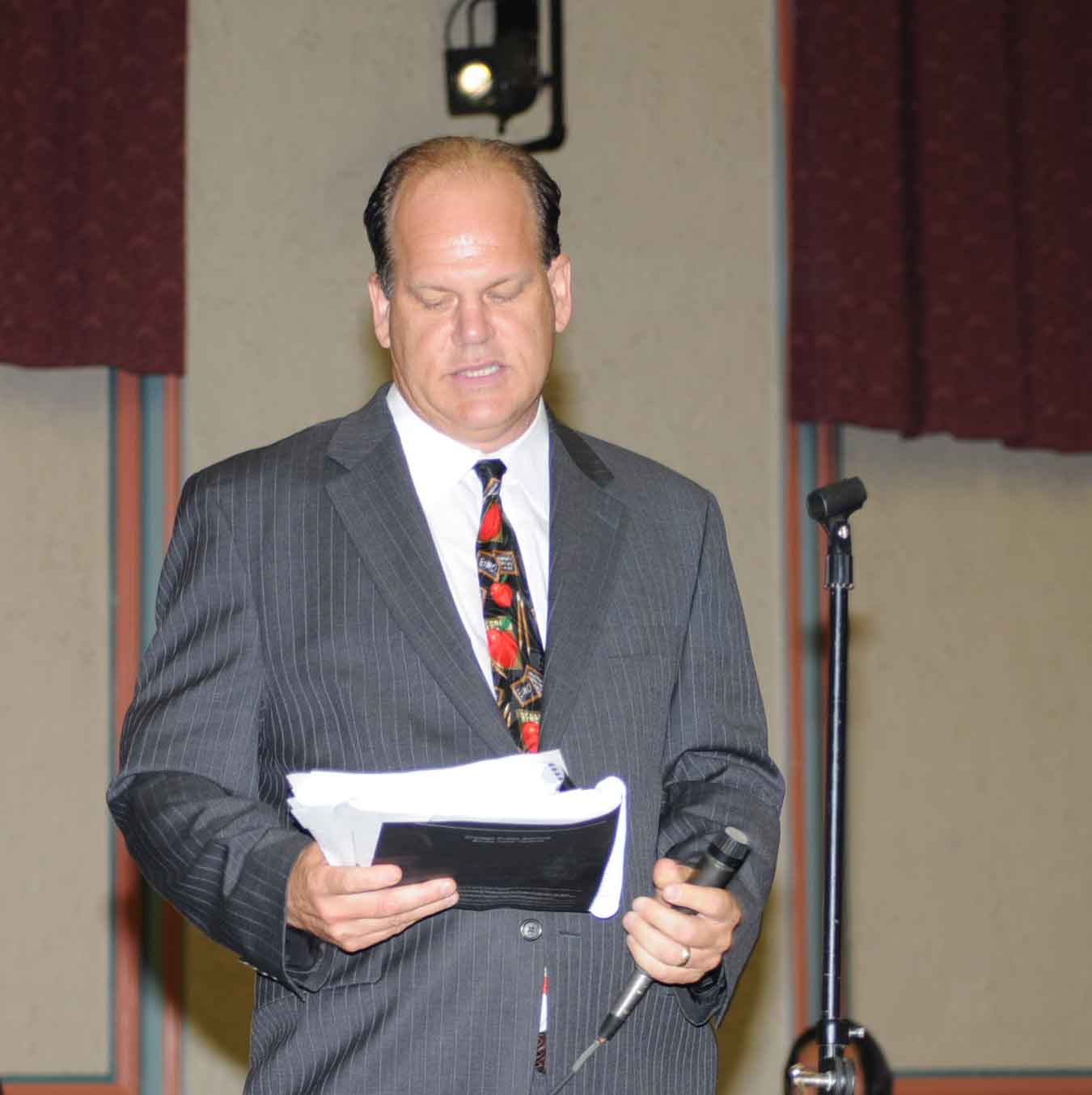

[Editor's Note: The following are the remarks delivered by Whitney Young High School teacher Jay Rehak at the August 17, 2009 hearings on the proposed Chicago Public Schools budget for 2009 - 2010.  During the first of three Chicago Public Schools budget hearings, on August 17, 2009, Whitney Young High School teacher Jay Rehak (above, holding microphone) stunned the audience by revealing that in the 2007 - 2008 school year CPS had lost at least $60 million because of investments in derivatives through Lehman Brothers, the now bankrupt Wall Street Investment Bank. Citing the FY 2008 Comprehensive Annual Financial Report (CAFR), Rehak noted that the investments in derivatives by CPS during the past two years totalled an apparent amount in excess of $400 million, all of which may have been lost because of the speculative nature of such investments. Because the CAFR is not published until six months after the fiscal year ends, Rehak noted, CPS has not yet revealed the total extent of the losses in derivative investments. CPS officials told Rehak they would get the information by the time of the public hearing scheduled for Marshall High School on August 18, 2009. Substance photo by George N. Schmidt.

During the first of three Chicago Public Schools budget hearings, on August 17, 2009, Whitney Young High School teacher Jay Rehak (above, holding microphone) stunned the audience by revealing that in the 2007 - 2008 school year CPS had lost at least $60 million because of investments in derivatives through Lehman Brothers, the now bankrupt Wall Street Investment Bank. Citing the FY 2008 Comprehensive Annual Financial Report (CAFR), Rehak noted that the investments in derivatives by CPS during the past two years totalled an apparent amount in excess of $400 million, all of which may have been lost because of the speculative nature of such investments. Because the CAFR is not published until six months after the fiscal year ends, Rehak noted, CPS has not yet revealed the total extent of the losses in derivative investments. CPS officials told Rehak they would get the information by the time of the public hearing scheduled for Marshall High School on August 18, 2009. Substance photo by George N. Schmidt.

Mr. Rehak supplied Substance with a draft of his remarks, and the following is based on our reporters' notes plus that material. CPS budget officials told the audience that they would have the answer to Mr. Rehak's questions by the August 18 budget hearings, scheduled to be held at Marshall High School (3250 W. Adams) beginning at 7:00 p.m. on August 18. George N. Schmidt, editor, Substance].

My name is Jay Rehak, I am a 20 year veteran Chicago Public School teacher. I currently teach English at Whitney Young High School, I am also a parent of three children, all of whom have attended the Chicago Public Schools, two have graduated, one is still in CPS. Additionally, I am a taxpaying Chicago homeowner. So I feel very invested in this process.

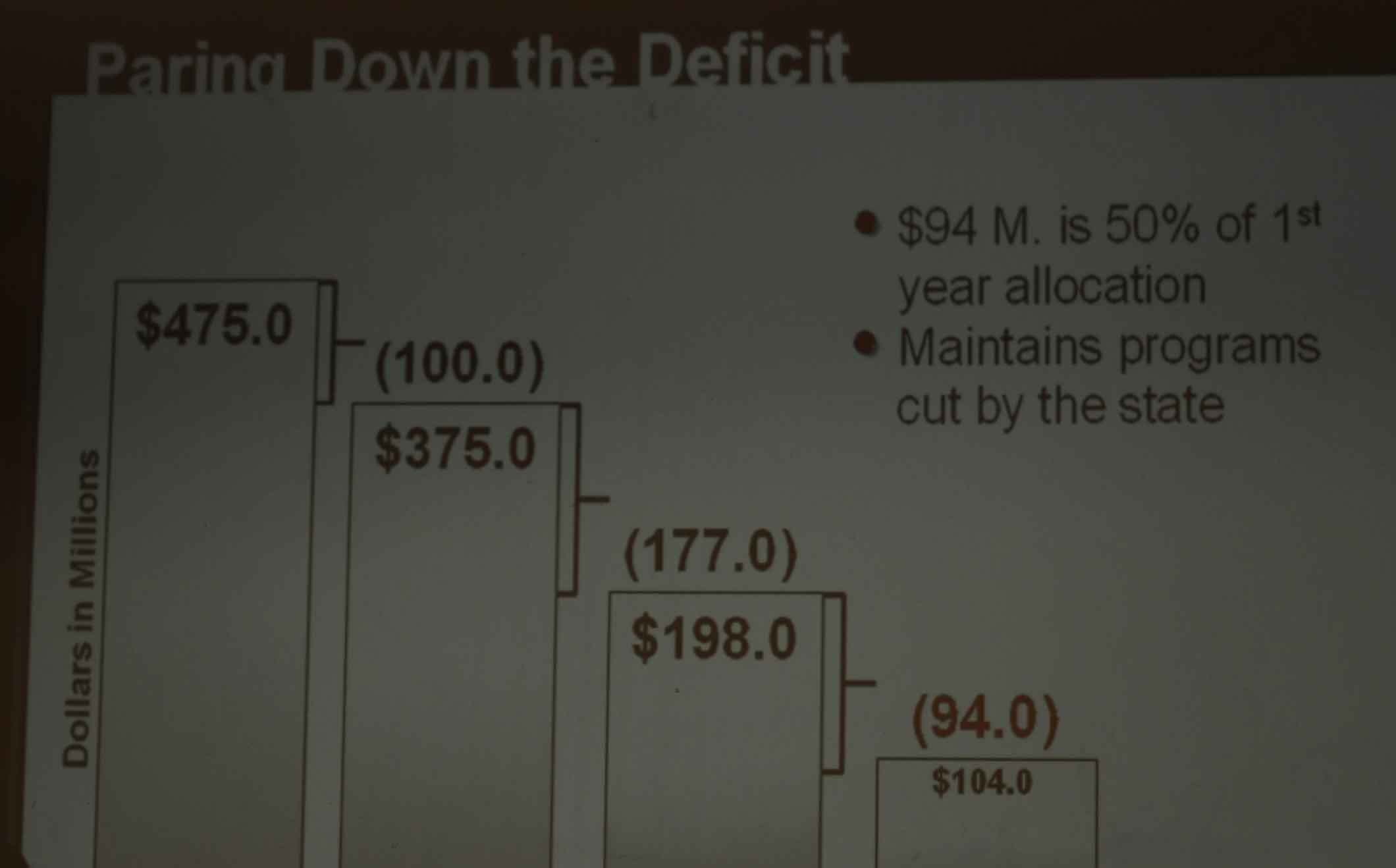

One of the many Power Point slides utilized during the CPS budget presentation "explained" how CPS had reduced what it had claimed in February 2009 was a "deficit" of $475 million. Despite repeated reports in Chicago's corporate media about the $475 million "deficit", CPS was never required to document those claims, made repeatedly in the media by Chief Executive Officer Ron Huberman. It was only at the August 17, 2009 budge hearing that CPS had been forced to admit that it had lost a significant amount of money through recklessly speculative investments in so-called "derivatives." CPS officials promised to document the total amount lost in those investments at the August 18 budget hearing. Substance photo by George N. Schmidt. Prior to reading the proposed CPS budget for the 2010 fiscal year, I read through the last comprehensive Annual Financial Report (CAFR).

One of the many Power Point slides utilized during the CPS budget presentation "explained" how CPS had reduced what it had claimed in February 2009 was a "deficit" of $475 million. Despite repeated reports in Chicago's corporate media about the $475 million "deficit", CPS was never required to document those claims, made repeatedly in the media by Chief Executive Officer Ron Huberman. It was only at the August 17, 2009 budge hearing that CPS had been forced to admit that it had lost a significant amount of money through recklessly speculative investments in so-called "derivatives." CPS officials promised to document the total amount lost in those investments at the August 18 budget hearing. Substance photo by George N. Schmidt. Prior to reading the proposed CPS budget for the 2010 fiscal year, I read through the last comprehensive Annual Financial Report (CAFR).

That report is available to the public, although it doesn't come out until about six months after the end of each fiscal year. So the most recent one was released in December 2008 or January 2009, but only covers the period through June 30, 2008. The audited Comprehensive Annual Financial Report of the Chicago Public Schools for FY 2008 noted that as of June 30th, 2008, CPS had $95 million invested in derivatives through Lehman Brothers.

According to the most recent CAFR, CPS also had $90 million in derivatives invested through Goldman Sachs, $100 million invested in derivatives through Bank of America,

and $162 million invested in derivates through Royal Bank of Canada.

In total, CPS, as of June 30, 2008, through those four entities, had $457 million invested in highly speculative derivatives.

Well, we all know what happened to Lehman Brothers a couple of months later, although it’s unclear what happened to all our money. Anyway, I note that as of June 30th, 2008 the CPS Comprehensive Annual Financial Report stated that aggregate $457 million invested in derivatives had lost $63 million of their value.

But that still leaves $397 million in highly speculative derivatives unaccounted for. I mention this now because on .pdf page 49 of the "Proposed Budget for 2009 - 2010" (the budget we're discussing here tonight), CPS notes a large decline in investment earnings.

My main question is this: Is any of this decline due to losses from the CPS utilization of derivative instruments, and if so, how much is this loss?

As you know, since February of this year, the Board of Education line has been that CPS has been facing a $475 million "deficit" (according to Ron Huberman). Yet at the same time, CPS has said it didn't need to raise taxes to the cap. Tonight, we hear that the alleged causes for this year's deficit — and future deficits — are obligations to the Chicago Teachers Pension Fund (CTPF) and teacher pay raises which are in the Chicago Teachers Union contract. There has been no mention of how much money CPS management lost because of speculative investments over the past year or two. Mayor teachers have to give in too.

As Jay Rehak was questioning the investment losses of CPS because of speculative investments in derivatives through Lehman Brothers, Goldman Sachs, Bank of America, and Royal Bank of Canada, CPS budget director Christine Herzog (above holding microphone) promised to get the total amount of the loss to the public by the time of the budget hearings at Marshall High School on August 18. Substance photo by George N. Schmidt.The mayor has been talking about how teacher pay raises are too high. The Board has tried to put through legislation to cap legislatively how much CPS can put into the pension fund. But one of the big scandals of the past year has been derivative trading. The public has the right to answers to the serious questions about this huge swap with Lehman Brothers. — and all of the other banks that CPS contracted with for this purpose.

As Jay Rehak was questioning the investment losses of CPS because of speculative investments in derivatives through Lehman Brothers, Goldman Sachs, Bank of America, and Royal Bank of Canada, CPS budget director Christine Herzog (above holding microphone) promised to get the total amount of the loss to the public by the time of the budget hearings at Marshall High School on August 18. Substance photo by George N. Schmidt.The mayor has been talking about how teacher pay raises are too high. The Board has tried to put through legislation to cap legislatively how much CPS can put into the pension fund. But one of the big scandals of the past year has been derivative trading. The public has the right to answers to the serious questions about this huge swap with Lehman Brothers. — and all of the other banks that CPS contracted with for this purpose.

How were these decisions made, and by whom?

I don't remember any reports from in the press that the Chicago Board of Education had approved such huge gambles. Did we outsource that decision making? Why did you decide to get into this matter one year ago? As everyone knows, the leadership here is supposed to be conservative. In 100 years issuing bonds and investing the people's money, has CPS ever ever done this? Why are you blaming our pensions for reckless losses and highly risky investments. Competent people chosen? [Editor's note: CPS budget chief Christine Herzog told Mr. Rehak and the audience that she would have the information about the total losses on these investments by the budget hearing of August 18, 2009, at Marshall High School in Chicago.

Final edited version of this article posted at www.substancenews.net August 18, 2009, 6:00 a.m. CDT. If you choose to reproduce this article in whole or in part, or any of the graphical material included with it, please give full credit to SubstanceNews as follows: Copyright © 2009 Substance, Inc., www.substancenews.net. Please provide Substance with a copy of any reproductions of this material and we will let you know our terms — or you can take out a subscription to Substance (see red button to the right) and make a donation. We are asking all of our readers to either subscribe to the print edition of Substance (a bargain at $16 per year) or make a donation. Both options are available on the right side of our Home Page. See "CLICK HERE TO SUBSCRIBE" or "CLICK HERE TO DONATE." For further information, feel free to call us at our office at 773-725-7502.

Comments:

By: George N. Schmidt

CTPF investments in derivatives -- and CPS updates

Goldman was not the only outfit that shorted the stock of outfits that bloated (then went bankrupt) because of CDOs and other derivatives. The capitalist class rigs the investing game as completely as the casinos rig the slot machine areas. The longer you play, the more you're going to lose. But you'll "win" just enough so you keep playing (until you're wiped out or bailed out; only in the USA, only the richest get the bailouts -- everyone else pays, then pays some more).

I won't have time to post all that happened at the Tuesday (August 18) budget hearings at Marshall High School, but the Board brought their Treasurer just to explain to Jay what those numbers meant. They claim it wasn't investments, but bond strategy.

Jay made sure the guy was on the record by asking him to explain his answer to Monday's question (see above, Jay's remarks) on the record at the Marshall High School budget hearing. When we get the transcript you can read that.

What's most clear right now is that -- as everyone has been saying -- this budget is designed to confuse, not illuminate.

The answer to your question about CTPF investments is "yes." The difference between CTPF and CPS, however, is that you can read just what was invested, through whom, and on what basis on the CTPF website. (www.ctpf,org).

CPS lies and covers up. At least CTPF let's you know when it has screwed up (which it did with those investments, although they weren't vast in comparison with the size of the CTPF fund at the time they crashed).

By: Theresa D. Daniels

retired teacher

What Jim Vail said plus another Bravo.

By: Jim Vail

Give 'em hell Jay!

Say - what about the Chicago Teachers Pension Fund. Did they also invest the retirement money in highly speculative derivatives? Could we compare the two - CPS and CTPF? Any careful look at the subprime mess that helped launch this current crisis would tell you to be very careful buying this stuff. Heck, even Goldman who sold this shit, quickly turned around and shorted it, knowing full well it would easily collapse because it was just that - speculative.