'The problem with the strategy of public cuts and corporate subsidies is that such an approach undermines the real economy...' Chicago Teachers Union releases major report on pensions

The Chicago Teachers Union released another research report on the morning of February 17, 2014, on the even of the planned lobbying campaign in Springfield scheduled for February 19. The lengthy report, which includes discussion of all the issues and which places the proposed cuts in public worker pensions in the context of economic policies which plunder the public on behalf of the nation's biggest corporations and wealthiest individuals, details, as have previous CTU reports, the contradictions in public policies and media stereotypes currently in fashion.

The new study entitled "The Great Chicago Pension Caper: New CTU study shows disparate impact of slashing teacher pensions in an age of austerity..."

THE CTU PRESS RELEASE ISSUED ON THE MORNING OF FEBRUARY 17 FOLLOWS:

CHICAGO � The Chicago Teachers Union (CTU) today released a report examining the true impact of pension cuts on the public sector workers living in our city�s neighborhoods. Three of the top four employers in Chicago are the City itself, the Chicago Public Schools and Cook County. These three entities employ over 90,000 people, all of whom depend on public pension plans to ensure dignified retirements and stable communities. The mayor�s proposal will amount to roughly $270 million in cuts to retirement income over a period of just five years.

The report, �The Great Chicago Pension Caper: Neighborhood Destabilization in an Age of Austerity,� was authored by CTU�s Research Department. It shows that when Senate Bill 1 is used as a model for so-called pension reform teachers, police, firefighters, librarians, social workers, engineers and other public sector workers in Chicago are likely to see their retirement incomes reduced by at least 10 percent over a 20-year period. Pension cuts will immediately harm retiree livelihoods and also disrupt current city workers� retirement planning. [SB1 is the pension cutting legislation passed by the Illinois General Assembly. If it survives legal challenges will reduce pension benefits for hundreds of thousands of workers in the state pension systems.]

�This report demonstrates the unintended consequences of misguided pension reform,� said CTU President Karen Lewis. �SB1 and proposals similar to this will not fix the problem. We need sensible revenue solutions. People need to understand that our retirees do not receive social security and have to pay for Medicare Part A out of our own pockets. We must put an end to this pension caper so that people can survive in an economy that is not kind to older Americans.�

Current public workers will have their pensions reduced the most. Many will face nearly a 20 percent cut in anticipated retiree income over their first two decades of retirement. These cuts will negatively impact not only public workers� quality of life but entire communities.

�The Great Chicago Pension Caper� also shows:

� The pension benefits earned by teachers support roughly 6,000 jobs in the City of Chicago alone.

� SB1, as applied to the Chicago Teachers� Pension Fund, will see an average cut totally about $700 per month, or a 20% reduction in the average CTPF benefit of $42,000 per year.

� Retirees living in the city�s majority-Black zip codes earn over $600 million in annual pension incomes from the four public funds. The African American middle class in Chicago will be the hardest hit by reductions in retirement benefits.

For more information please visit CTU�s website at www.ctunet.com.

Chicago Mayor Rahm Emanuel (shown above at his February 2014 publicity stunt on behalf of the Noble Street ITW charter school) has been part of the corporate attack on public worker jobs and pensions. Substance photo by George N. Schmidt.The 13-page report �The Great Chicago Pension Caper: Neighborhood Destabilization in An Age of Austerity" follows. It is also available with its notes and illustrations in PDF format at www.ctunet.com.

Chicago Mayor Rahm Emanuel (shown above at his February 2014 publicity stunt on behalf of the Noble Street ITW charter school) has been part of the corporate attack on public worker jobs and pensions. Substance photo by George N. Schmidt.The 13-page report �The Great Chicago Pension Caper: Neighborhood Destabilization in An Age of Austerity" follows. It is also available with its notes and illustrations in PDF format at www.ctunet.com.

�The Great Chicago Pension Caper:� Neighborhood Destabilization in An Age of Austerity"

(CONTACT: Stephanie Gadlin. February 17, 2014 312/329-6250)

For the last 30 years, and especially since the onset of the Great Recession [2008], the American public has been presented with a false choice: slash or privatize public services, public employees, and public assets or face economic stagnation. Civic Chicago and the state of Illinois have embraced this false choice, and it is this austerity narrative under which Mayors Daley and Emanuel leased the city�s parking meters for a fraction of their value, dramatically cut library hours, left hundreds of police and other city positions unfilled, laid off thousands of teachers and school support staff, and shuttered half of the city�s mental health clinics. Mayor Emanuel has proposed and advocates for the latest massive cut: city workers� retirement security.

At the same time that governments have cut public services, the city and state have showered corporate tax subsidies on some of the wealthiest companies in the region. Chicago�s TIF program has provided big box stores, luxury car dealerships, the Chicago Mercantile Exchange, Boeing, and United Airlines with tens of millions in financial support despite no demonstrated need. Moreover, on the same day that the Illinois legislature voted to deeply slash state workers� pensions, the Senate also voted to provide Archer Daniels Midland with a generous package of subsidies to move its headquarters from Decatur to Chicago.

It is troubling that hard-working Chicagoans are asked to bear the lion's share of the burden of budget cuts while they are falling further behind wealthy families. The problem with the strategy of public cuts and corporate subsidies is that such an approach undermines the real economy. Further deep cuts to retirement security will only impair our already-fragile economic recovery. �The Great Chicago Pension Caper: Neighborhood Destabilization in an Age of Austerity,� examines the impact of drastic pension cuts on the public sector workers living in Chicago neighborhoods. The estimates of future cuts are based on a calculation that uses Senate Bill 1, the pension cutting bill passed by the Illinois General Assembly if the bill survives the legal challenges, it will reduce pension benefits for hundreds of thousands of workers in the state pension systems.

When SB1 is used as a model for cuts, teachers, municipal workers and retirees in Chicago are likely to see their retirement incomes reduced by at least 10% over a 20 year period.(1). Pension cuts will immediately harm retiree livelihoods and also disrupt current city workers� retirement planning. Current public workers will have their pensions reduced the most: many will face nearly a 20% cut in anticipated retiree income over their first two decades of retirement. These cuts will negatively impact not only public workers� quality of life but entire communities.

Chicago�s retirees form the stable core of their neighborhoods. None of the top 15 Chicago zip codes as ranked by the annual amount of public employee retirement benefits are located near downtown.

Women make up three-quarters of the Chicago Teachers Pension Fund (CTPF) and 60% of the Municipal Fund (MEABF), and the public sector jobs that provided people of color a pathway to the middle class also provide a dignified retirement. Cuts to pensions thus disproportionately impact women and people of color. Having barely weathered the impacts of the 2008 financial crisis, we find that the very communities that are bastions of the middle class are now in peril of facing another economic disaster in the form of future pension cuts.

While this study examines the proposed legislation�s impact on the city of Chicago, the effects of cuts to city retirement funds will be felt far beyond Chicago�s 77 community areas. For instance, while approximately half of CTPF retirees live outside of the city, approximately 85% live in Illinois, most in the Chicago metro area. Cuts to these retirees� incomes will impact the city, Cook and surrounding counties, and Illinois as a whole through reduced economic activity and lower tax revenue.

According to Deborah Pope, a 30-year veteran high school history teacher, �If I lost 10%-to-20% of my hard-earned retirement, I�d have to work part-time just to pay my medical insurance. I�d also have to give up or significantly scale back visits to family out of town, holiday and birthday gifts for my children and supporting local restaurants with a weekly dinner out. My husband has no pension, just social security. We might have to consider selling the home we have worked long and hard to purchase because our mortgage is quite steep. If we had to sell now, we�d lose a lot of the equity we have in the house.�

It is difficult to measure the extent to which these projected cuts will further undermine the already precarious state of affairs for countless Chicago families. As retired educator Sandra Stone has expressed, only a year into retirement she is already wondering if she can afford her current lifestyle:

�This past year and a half, I've been adjusting to my new income. I've been concerned I might not be safe or at least comfortable over the long run on the checks I've been receiving. Thoughts of what the house may need, what happens if I should have expensive medical needs, if my daughter suddenly has an emergency, the car breaks down, if I were to slip on the ice outside my home.... I was even beginning to calculate when would the best time to (die) based on what I was receiving, my expenses, and what lay ahead. These are private thoughts but I assume everyone who is aging has them.�

Retirement Insecurity in a Period of Cutbacks

In recent years Illinois has become the poster-child for state budget deficits and inadequately funded pensions. The New York Times starts virtually every article about the state with a caveat mentioning, �one of the nation�s worst-financed state employee pension systems.� (2). Ordinarily, news coverage focuses on the breadth and depth of the unfunded pension liability but rarely explores the impact of reducing the retirement incomes for hundreds of thousands of existing and future retirees.

Virtually unreported is the fact that the city has thousands of public servants, such as teachers, police and firefighters. Librarians, social workers and engineers, who have dedicated a lifetime of service to the neighborhoods in all of Chicago�s 50 wards where they live, work and spend their income. In fact, three of the top four employers in Chicago are the City itself, the Chicago Public Schools and Cook County. These three entities employ over 90,000 people, all of whom depend on public pension plans to ensure dignified retirements and stable communities.

Patricia Boughton, a teacher at Harlan Community Academy, works and lives in the Roseland Community, a neighborhood that has been struggling economically for years since the loss of the area�s steel industry in the late 70s and early 80s.

�I am most concerned about my quality of life. I had hoped that when I retired I would be able to do a little traveling, and entertaining, etc. I have grandchildren, whom I had hoped to help a little with their schooling. I still like going to the beauty shop in my community, but cuts in benefits would severely curtail those types of activities and I would have to concentrate on keeping up with my meds, food, and shelter.�

It is seldom mentioned that retired public sector workers in state pension systems do not receive social security, and many businesses depend on them to spend their retirement dollars within the community.

For Regina O�Connor, a 20 year veteran elementary school teacher, the lack of social security income combined with pension cuts would cause great difficulty for her household, �Teachers are not generally eligible for Social Security benefits. Even though I stayed home for several years to raise my children while my husband worked, I will be denied receiving those benefits. My husband worked all of his adult life. He had no idea that his widow could be reduced to penury because she chose to teach children after raising her own.�

Chicago families can ill afford more bad economic news as the city struggles to rebound from a crippling foreclosure crisis and anemic job growth in virtually every area outside of the central business district. The largest number of school closures in American history followed by devastating school budget cuts has left communities reeling. Last fall Chicago�s foreclosure rate was the third-highest among the nation�s 20 largest metropolitan areas. National data shows that during the Great Recession and foreclosure crisis, the housing security of older Americans deteriorated the most.3 Maintaining retirement security is essential to keep neighborhoods from becoming further littered by abandoned boarded up homes, empty school buildings and shuttered businesses.

Meanwhile, despite the Mayor�s claims of �job creation�, the bad economic news continues. Layoffs at Macy�s, Sears, Motorola, and Dominick�s in the last few months alone will affect over 9,700 Chicago workers and their families.(4).

Mayor Rahm Emanuel has proposed to compound this already bleak picture by enacting hundreds of millions in pension cuts over the next 5 years.

The squeeze on public sector workers comes at the same time that the top 1 percent of Americans has seen record income growth amidst steadily increasing income inequality. The retirement security of Chicago�s 90,000 public servants plays a crucial role in helping keep our communities intact. We must recognize the value of investing in good jobs and stable communities. This goal can only be achieved by enacting policies that close corporate loopholes, make the wealthy pay their fair share, and explore ways to create a more just taxation system that preserves and expands city services and education initiatives like universal pre-k. As with other public sector programs, the so-called pension crisis is a revenue issue, but the proposed solutions not only delay new revenue but actually diminish economic activity, thereby making long-term fund stability even more elusive.

Pension cuts will hurt Chicago�s economy

When retirees are able to count on a steady pension for retirement security, they contribute to their local economies. Pension spending is a crucial to many communities since retirees are a key driver of economic activity in those neighborhoods. The proposed pension cuts to retirees in Chicago will amount to roughly $270 million cut from retirement income over 5 years. Such cuts alone would be problematic, but cuts to retirement security ripple through the wider economy.

The National Institute on Retirement Security (NIRS) calculates that in Illinois the economic multiplier for pension benefits is $1.72 of economic output for every $1 in pension benefits paid to retirees.(5). Consequently, the pension benefits earned by teachers support roughly 6,000 jobs in the City of Chicago alone. (6). The economic impact of retirement cuts and reduced spending could amount to over $460 million in damage to Chicago�s economy over 5 years.

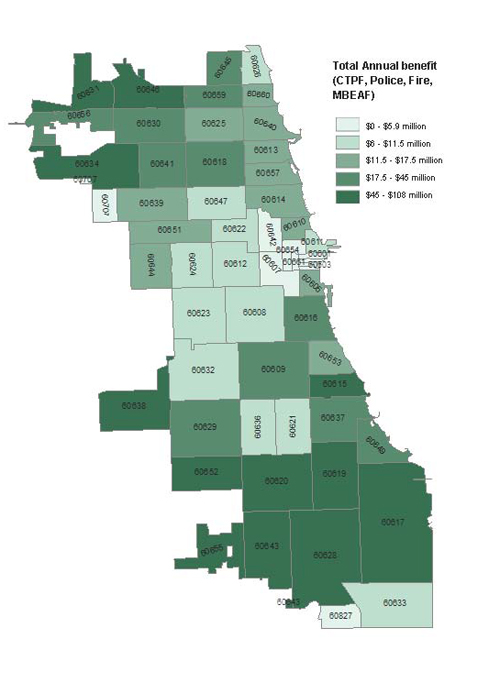

Figure 1 shows how much Chicago communities benefit from public pensioners.Figure 1 outlines annual retirement benefits by each Chicago zip code. The map clearly shows city worker retirees most densely live in northwest, south, and southwest neighborhoods. These neighborhoods form the stable middle-class core of the city and would face the most intense negative consequences of pension cuts. These neighborhoods are also bastions of middle class people of color and immigrants. The communities of Chatham, Roseland, Pullman, Auburn-Gresham, and South Shore, are all over 95% African American. South Chicago and Ashburn are over 80% African American and Latino, and Chicago Lawn and Portage Park are majority Latino.

Figure 1 shows how much Chicago communities benefit from public pensioners.Figure 1 outlines annual retirement benefits by each Chicago zip code. The map clearly shows city worker retirees most densely live in northwest, south, and southwest neighborhoods. These neighborhoods form the stable middle-class core of the city and would face the most intense negative consequences of pension cuts. These neighborhoods are also bastions of middle class people of color and immigrants. The communities of Chatham, Roseland, Pullman, Auburn-Gresham, and South Shore, are all over 95% African American. South Chicago and Ashburn are over 80% African American and Latino, and Chicago Lawn and Portage Park are majority Latino.

Communities with high concentrations of police and fire workers, like Mt. Greenwood, Norwood Park, Clearing, Jefferson Park, and Dunning, also continue to lose significant pension income. Police and fire retirees receive simple-interest annual increases that do not keep pace with inflation. Consequently, economic activity in these neighborhoods is constrained by fixed and declining retirement incomes.

The economic impact of pension cuts is exacerbated by the specific healthcare provisions in SB1. As passed, the bill prohibits pension funds from paying for retiree healthcare subsidies. As applied to CTPF, for instance, the average cut would total almost $700 per month, or a 20% direct reduction in the average CTPF benefit of $42,000. Applying the same multiplier as used above, SB 1 language applied to Chicago would reduce overall economic activity by more than $14,400 per retired teacher and administrator, or nearly $150 million per year based just on those residing in Chicago.

Unfortunately, this cut has already been imposed on other retired city workers. Forcing retirees to pay more of their healthcare costs is a direct drain on the rest of the economy. Mary Jones, a retired Chicago Public Librarian, speaks about the damage already done by cuts to retiree healthcare:

�Last year the City of Chicago went back on its promise to provide retirees with subsidies for health insurance. Now I�m paying $450 a month for health insurance because like most city employees I�m not eligible for Medicare. Now they want to cut our pension benefits when we don�t get social security. It�s just not right. When I retired after working 33 years for the Chicago Public Library I thought I would be able to live with a bit of security and dignity. The City of Chicago should not be allowed to betray its retirees.�

Pension cut impact on Black neighborhoods

The threats to retirement security will impact all of Chicago�s middle class communities, but in some neighborhoods the impact will be especially hard felt. A history of segregation, employment discrimination, and inequalities in access to educational and other resources in Chicago have left an impact on many neighborhoods. Public service jobs have been a major path to stable, middle class employment and retirement for people of color in Chicago when other doors were slammed shut. This legacy also means that cuts to public employee retirements hit the African American community disproportionately hard.

Retirees living in the city�s majority-black zip codes earn over $600 million in annual pension incomes from the four public funds analyzed here. Many of these same communities have been destabilized by decades of policies that prioritized downtown at the expense of neighborhoods.

Patricia Boughton elaborates on the impact that cuts to pensions would have on her community in Roseland:

�I heartily believe in spending within my community in order stimulate job growth and opportunities for young people as well as young entrepreneurs. If my retirement benefits are cut, I would not be able to maintain my property to the standards of my community and to my personal standards as well. I pay people to care for my lawn, and to make repairs around my home. This is very important to property values. People want to live in areas where homes are well maintained; this costs money. I am unable to do this work myself and a pension cut would guarantee that I would not be able to afford to pay anyone to do it for me. I spend money at the local Jewel and Walgreens, Dollar stores, clothing boutiques, etc.

"At one of the beauty shops that I used to frequent, the owner had to close her business because most of her clientele were teachers and when they lost their jobs, one of the first cuts they made were for her services. When she closed, several of her operators had to find other positions, the manicurist lost her job, the receptionist was laid off, etc.

"At stores such as our local Walgreen's a large part of their business comes from retirees from the city, state, and federal government. In addition to spending on prescriptions, we buy other items as well. Because we are such loyal customers, the stores have been viable and are able to hire workers from the community. This is extremely important because we have a high rate of unemployment in the community and many of the stores depend on retirees to help maintain their bottom line. Anything that disrupts that would be immediately felt in the forms of layoffs, store closings, etc.�

The community of Beverly/Morgan Park, roughly three-quarters African American, will be the hardest hit in all of Chicago. Chatham, Roseland, Pullman, Auburn-Gresham, and South Shore, which also face steep income cuts, are all over 95% African American. The proposed benefit reductions would represent a divestment of tens of millions of dollars in each of these communities. Worse, these cuts would be targeted at the mid-income seniors and homeowners that play a key role in defining and stabilizing neighborhoods that already have been particularly impacted by the economic downturn.

These communities were seriously destabilized over the last decade by the loss of employed residents. A 2013 report by the Grassroots Collaborative found that these neighborhoods lost from 2,000 to 7,000 employed residents each from 2002 to 2011.7 These neighborhoods were largely left out of the rising downtown prosperity at the same time local jobs also disappeared. The Great Recession further undermined employment. Even three years into the �recovery�, Black unemployment in Chicago stood at 19.5%, almost double the 11.4% rate for all Chicago. (8).

CTPF and MEABF pensions fund benefits Black communities that will be most affected by retirement cuts have also been destabilized by job losses

These communities have not only borne the brunt of private sector job loss and foreclosures, but have also weathered deep public sector service cuts like mental health clinic closures, school closures, and layoffs that impacted the many public sector workers residing in the neighborhoods. Figure 2 identifies the devastating scale of job loss over the last several years.

The public-sector has played a significant role in the history of black employment and the creation of the black middle-class in Chicago. A comparison of black employment in the public sectors and manufacturing found that �government, more so than manufacturing, served as black Chicagoans� most persistent and disproportionate sector of employment throughout the second half of the twentieth century � a singularly African American employment trend�.(9). However, Black workers in the public sector currently represent just under a quarter of all Black workers in Chicago. (10).

The brunt of the looming pension cuts and public sector cut backs pushed by the Mayor and big business would be disproportionately felt by Chicago�s Black communities. These cuts would threaten to not only foreclose the path to the middle class, but to also roll back important gains achieved by the Civil Rights Movement in Chicago. Cutting pensions is a plan for downward middle class mobility.

Guidelines for a fair solution

A fair solution that ensures retirement security for Chicago�s public sector workers and investment in our communities requires a sea-change in how revenue is generated for public services. Chicago�s City leaders must reassess their commitment to the majority of our residents who live outside of the loop and the Gold Coast.

Chicago�s political and business leaders have sped the city towards their vision of a �global city� which invests almost exclusively in the downtown area and in select north-side neighborhoods. Working class Chicagoans have subsidized this growth through the innumerable tax credits for corporations, TIF funds that have gone to gentrifying and established neighborhoods rather than to blighted communities, and a regressive tax structure that fails to extract revenue from those most able to pay.

Our political leaders continue to champion the narrative that the path to prosperity requires cutbacks in essential services and promises made to public sector workers. The narrative that public sector workers need to bear the burden is essential to the interest of corporations. A recent report from Good Jobs First found that corporations benefit from over $2.4 billion in tax evasion, credits and subsidies annually from the state of Illinois.(11). Meanwhile, corporate profits are back up and have surpassed their pre-recession levels.(12).

Our proposed revenue solutions will ensure a stable tax base that primarily targets corporations and those most able to pay.(13)

- Close corporate tax loopholes and end corporate subsidies

o Tax reforms such as subjecting foreign dividends to the corporate state income tax, eliminating the Economic Development for A Growing Economy expenditure and repealing the subsidy to the CME and the CBOE could generate $10 million.

- A graduated income tax at the state level to replace the flat tax rate

o The city would see $11 to 12 million in additional revenue

- Broadening the service tax base and lowering the rate

o Broadening the tax base at the current rate to include services such as finance, insurance, real estate, automotive, construction, among others, could bring in from just under $500 million to over $1.3 billion.

- A graduated city income tax for residents and all employees of companies located in Chicago, similar to the Philadelphia Wage tax.

o A 1% tax on city and commuter income could generate $800 million. Alternatively, a 1.5% tax only on those earning over $100k could generate a similar amount.

- A property tax in line with neighboring suburbs to enhance competitiveness of public services

o Increasing the city of Chicago�s property tax rate by 0.115 percentage points could generate $75 million. Even with the increase the city of Chicago would still rank near the bottom of effective property tax rates across the Chicago region.

- Closure of non-blighted TIFs and return of revenue to all local tax bases.

o Closure of all TIFs could return $80 million to the City of Chicago and $202 million to the Board of Education annually. Closing only the top 10 TIFs by 2013 revenue would secure $200 million for affected taxing bodies.

Numbers are based off of Center for Tax and Budget Accountability (CTBA) calculations of city and state data, estimates released by Chicago Inspector General Joe Ferguson, tax rates from the Cook County Clerk�s tax rate report, CTU estimates based on figures from the Illinois Department of Revenue, and data from the City of Chicago�s TIF Projection Report.

- Institute a Financial Transaction Tax

o A $0.01 tax on each traded contract on three of Chicago�s largest exchanges for financial products would bring close to $40 million annually for the City of Chicago.

The estimates of revenue from pursuing these progressive and sensible revenue options could total from $1.6 to $2.4 billion in revenue for the City of Chicago. A fair and just solution to underfunded pensions is to update our tax system to one that ensures the rich pay their fair share. Since the last financial crisis, working-class communities have coped with foreclosures, job loss, a shrinking safety net, and public service cuts. The financial sector, thanks to taxpayer-funded bailouts, climbed to record profits during this unbalanced recovery. Stopping pension theft and ensuring promised retirement security for our public sector workers, is one of many volleys that must be launched to secure middle-class neighborhoods and prosperity for all.

FOOTNOTES:

1. Included in the analysis are the CTPF and MEABF pension funds. Calculations are based on We Are One COLA Calculator, http://www.ieanea.org/2013/12/04/cola-calculator/

2. http://www.nytimes.com/2013/12/04/us/politics/illinois-legislature-approves-benefit-cuts-in-troubled-pension-system.html

3. http://www.nytimes.com/2012/07/19/us/foreclosure-rates-surge-for-older-americans-aarp-says.html

4. http://articles.chicagotribune.com/2014-01-09/business/chi-macys-layoffs-store-closings-20140108_1_macy-premarket-trading-stores

5 http://www.nirsonline.org/storage/nirs/documents/factSheetsPreviews/Factsheet_IL.pdf

6 http://ctpf.org/general_info/advocacy/economic_impact.pdf

Figure 1. Total annual retirement income of public retiree residents of Chicago by zip-code

7

Figure 1: Annual Retirement Benefit Values by Zip Code

8

7 http://www.thegrassrootscollaborative.org/sites/default/files/DowntownProsperityNeighborhoodNeglect.pdf

8 http://www.bls.gov/opub/gp/pdf/gp12_27.pdf

Zip CodePrimary community# of Employed Persons Lost, 2002 to 2011*Projected 5-year cut in total pension payouts to resident pensioners**% African American of zip code residents 60643Beverly/Morgan Park2072$ 21 million74%60619Chatham4630$ 19 million97%60628Roseland/Pullman6996$ 16 million94%60620Auburn-Gresham5688$ 13 million98%60649South Shore3474$ 10 million95%* U.S. Census Bureau, OnTheMap Application and LEHD Origin-Destination Employment Statistics**

9 Virginia Parks (2011). �Revisiting shibboleths of race and urban economy: Black employment in manufacturing and the public sector compared, Chicago 1950-2000.� International Journal of Urban and Regional Research. 35(1): 110-129

FIGURE 2 TITLE. Figure 2: Job Loss in Southside Neighborhoods Source ��Downtown Prosperity, Neighborhood Neglect�� report by The Grassroots Collaborative, 2013

10http://www.progressillinois.com/quick-hits/content/2011/07/26/op-ed-attack-chicagos-public-employees-hits-minorities-hardest

11 http://www.goodjobsfirst.org/sites/default/files/docs/pdf/statepensions_illinois.pdf

12 http://www.nytimes.com/2013/03/04/business/economy/corporate-profits-soar-as-worker-income-limps.html