HJRCA 49 -- Vote NO! on election day... House Joint Resolution Constitutional Amendment 49 Is an Attempt to Diminish the Rights and Benefits of Public Employees

By now, most of us know what the “Pension Clause” or Article XIII (General Provisions), Section 5 (Pension and Retirement Rights) of the Illinois Constitution states: “Membership in any pension or retirement system of the state or any local government or school district, or any agency or instrumentality thereof, shall be an enforceable contractual relationship, the benefits of which shall not be diminished or impaired.”

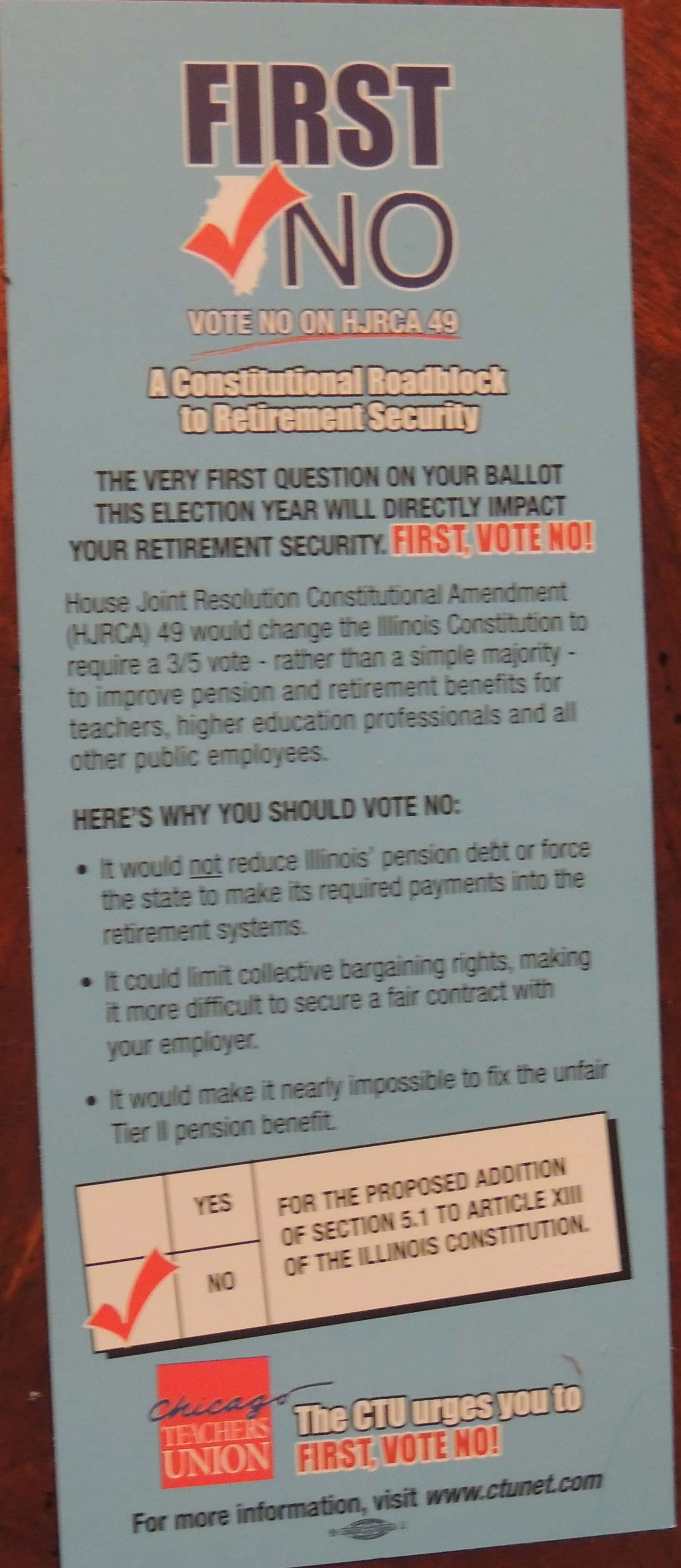

Informational palm card being distributed by the CTU.“[This] Pension Clause serves as a bar against any unilateral legislative or governmental action to reduce or eliminate the pension benefit rights in place when an employee [becomes] a member of the pension system” (Eric Madiar, “Is Welching on Public Pension Promises an Option for Illinois” 21).

Informational palm card being distributed by the CTU.“[This] Pension Clause serves as a bar against any unilateral legislative or governmental action to reduce or eliminate the pension benefit rights in place when an employee [becomes] a member of the pension system” (Eric Madiar, “Is Welching on Public Pension Promises an Option for Illinois” 21).

Nevertheless, House Speaker Michael Madigan’s constitutional amendment HJRCA 49 will “propose to amend the General Provisions Article of the Illinois Constitution. [This amendment] provides that no bill, except a bill for appropriations, that provides a benefit increase under any pension or retirement system of the State, any unit of local government or school district, or any agency or instrumentality thereof, shall become law without the concurrence of three-fifths of the members elected to each house of the General Assembly…

“[Furthermore, HJRCA 49] provides that no ordinance, resolution, rule, or other action of the governing body, or an appointee or employee of the governing body, of any unit of local government or school district that provides an emolument increase to an official or employee that has the effect of increasing the amount of the pension or annuity that an official or employee could receive as a member of a pension or retirement system shall be valid without the concurrence of three-fifths of the members of that governing body…

“The term ‘benefit increase’ means a change to any pension or other law that results in a member of a pension or retirement system receiving a new benefit or an enhancement to a benefit including, but not limited to, any changes that (i) increase the amount of the pension or annuity that a member could receive upon retirement, or (ii) reduce or eliminate the eligibility requirements or other terms or conditions a member must meet to receive a pension or annuity upon retirement.

“The term ‘benefit increase’ also means a change to any pension or other law that expands the class of persons who may become a member of any pension or retirement system or who may receive a pension or annuity from a pension or retirement system. An increase in salary or wage level, by itself, shall not constitute a ‘benefit increase’ unless that increase exceeds limitations provided by law… This Constitutional Amendment [will] take effect on January 9, 2013.”

Of course, this amendment to Article XIII, Section 5 of the Illinois Constitution will be cast on a separate ballot. As stated, this amendment to the 1970 “Pension Clause” will need three-fifths of those voting on the amendment or a majority of those voting in the election in order to pass. However, it is important to note that Illinois citizens have been duped by the Civic Committee of the Commercial Club of Chicago, the Chicago Tribune, and others; therefore, this amendment may pass, unless public employees unite to re-educate the public to “Vote No.”

Most public employees understand the cause of the $83 billion unfunded liability to the pension systems: “the state’s decades-long practice of intentionally borrowing revenue from ‘promised’ contributions to the retirement systems in order to subsidize the cost of delivering public services” (The Center for Tax and Budget Accountability CTBA, June 2012).

Some public employees and the majority of the public do not realize, however, that “the top two drivers of underfunding were insufficient employer contributions and investment losses during the Great Recession; [that] insufficient employer contributions account for 44 percent of growth in unfunded liabilities, and investment returns account for 22 percent of total growth. In contrast, benefit increases account for less than 10 percent of the growth [in unfunded liability]. Given the small role benefit increases played in creating the problem, it is unfair to target benefits [through HJRCA 49] in order to reduce the existing unfunded liability” (CTBA).

Most public employees and the populace do not comprehend that “the funding plan under Public Act 88-0593 [the “Ramp Up”] heavily back loaded repayment of the aggregate unfunded liability…; [that] HJRCA 49 does not reduce the state systems’ current $83 billion unfunded liability by even one cent. HJRCA 49 [also] fails to address the real fiscal issue caused by the state’s outsized pension debt—how to amortize the $83 billion debt owed to the five state-sponsored retirement systems in a feasible way.

“Second, implementing a Constitutional amendment that hinders the ability of legislators to institute benefit increases would make it nearly impossible to rectify the problems associated with the reduced benefit tier that lawmakers created in 2010 [with SB 1946]…

“The uncertainty surrounding language used in HJRCA 49 is of extra concern because once passed, changing any aspect of it would require yet another Constitutional amendment. Given that there are nearly 7,000 local governments in Illinois, the impact of the supermajority-voting requirement could be costly in both the amount of time legislators will have to spend on pension benefit analysis” (CTBA).

Most significantly, as stated by the State Universities Annuitants Association (SUAA), HJRCA 49 “would grant unprecedented powers to government that will undermine protections contained in the pension protection clause [Article XIII, Section 5] and eliminate the uniform laws that now exist for [all] state employee benefits and obligations in the Illinois Pension Code” (Letter from SUAA, April 25, 2012).

The Constitutional amendment (Section 5.1) to the Pension Clause appears to be an attempt to nullify Article I, Section 16 (Ex Post Facto Laws and Impairing Contracts) of the Illinois Constitution and Article I, Section 10 (Limitations on Power of States) of the U.S. Constitution.

How important is it now for public employees to educate the public about attacks on rights and benefits of middle-class citizens? Shouldn’t public employees be proactive and enraged by the Civic Committee’s persuasive attempt to divide the middle class in Illinois through fallacious reasoning and distorted information? Shouldn’t public employees be provoked by the Civic Committee’s relentless priority on radical “pension reform” and their policymakers’ attempt to breach the contract of public employees while giving tax cuts to corporations and the wealthy, regardless of whether this inequitable “corporate welfare” produces more budget deficits? The Civic Committee has shrewdly and deceptively maintained the dialogue and focus on public pensions instead of needed revenue reform, and not much has been done about it.

This government by the rich and powerful, or by a group that duplicitously states it is a “not-for-profit organization whose mission is to stimulate and encourage the growth of the area's economy and its ability to provide for its people,” is based upon the impoverishment of middle-class citizens. The Civic Committee’s and Civic Federation’s power is purchased. Their “current mission” is the wholesale destruction of the entire middle class and the pension systems in Illinois, especially the Teachers’ Retirement System.

Who is behind the vague and ambiguous laws by which Illinois government operates besides House Speaker Madigan? The Civic Committee and its legislative power brokers. Who will profit from pension reform and diminishment of contracts and, thus, free up the state’s cash flow and increase its profit margin in Illinois? The Civic Committee and its minions. Who could eventually lose their “only” retirement pension? The teachers and other public employees of Illinois.

There are no equal rights when there is inequity of wealth and when promises are made to underpin and to sustain the fortunes of a few at the expense and victimization of the many. Public employees know they have become victims of deregulation and tax reductions for the wealthy minority that are the result of organized political action by and in support of the wealthy sector.

Public employees know they will become victims of insidious financial “reforms” that do not resolve the state’s deficit problems but will continue to accommodate and reinforce the enormous inequality of organizational resources of these thriving egotistic profiteers among us, unless public employees choose to unite and fight against this injustice.

Public employees know they are victims of a tyranny by the few who lack accountability for destroying a representative democracy and a just economy in Illinois; public employees know they are victims of the corporate “We Mean Business” PAC and vast resources of money and influence committed to reforming the rules and policies that have and will continue to adversely affect the lives of middle-class citizens and the disenfranchised; moreover, most public employees know about the schemes to reallocate the state’s future liabilities to teachers and school districts and universities by way of procuring policymakers and about the attempt to circumvent Article XIII, Section 5 of the Illinois Constitution through House Joint Resolution Constitutional Amendment 49.

There is a simple synergetic balance to understand here. If the state’s policymakers impair the Pension Clause of its public employees, they will not only destroy the public employees’ financial security and their integrity, but they will also damage the communities that these people support, serve and protect.

Note: The question on the November ballot will ask, “…If you believe the Illinois Constitution should not be amended to require a three-fifths majority vote in order to increase a benefit under any public pension or retirement system, you should vote NO… on the question. Three-fifths of those voting on the question or a majority of those voting in the election must vote “Yes” in order for the amendment to become effective on January 9, 2013.”

If you do not vote at all, your absent vote will make it easier for a majority “Yes” vote.

Please Vote "No."

Comments:

By: Ken Previti

Vote NO on 49

The legalized corruption of the state legislature and the pressures placed on them by powers behind the Civic Committee's millionaire and billionaire backers have created a situation and an amendment proposal that is intentionally confusing to the public and damaging to all of the middle class of Illinois. It's downright un-American as legislators get their 30 pieces of silver as campaign funding to betray us all.

We simply must Vote NO on 49, or the corrupt win.

By: Patricia Herrmann

Its a ruse

They keep saying the amendment is about eliminating pension sweeteners. That there are local governments who spike an employee's last year of salary in order to reward an employee with a huge rise in their pension. Let's say that's true (when I think it is now illegal). Why is a Constitutional Amendment needed to prevent that when a law would do (and I think there already is one) in a simple direct way. Just pass a law. Actually the Amendment is needed because they are lying about it being about eliminating pension sweeteners. It's a ruse to overturn the Constitutional protection. And the 3/5th provision? Is simply undemocratic. It puts a minority in charge.

By: Todd Mertz

Amendment 49

As we all know, many legislators (probably now the majority) want to drastically reduce or completely eliminate our pensions. However, that is not so easy when the IL Constitution clearly protects our pensions in "...an enforceable contractual relationship, the benefits of which shall not be diminished or impaired” (Article XIII, Section 5).

So what is the easiest path for our legislators to eliminate their contractual obligations to teachers and public employees? Amend the Constitution.

We are only one of four states that have a strong pension protection clause in our state constitution...but perhaps only for one more month unless we ALL act and spread this news to VOTE NO ON 49 to our colleagues, family, and friends.

If we didn't have the "non-impairment provision" in the IL Constitution, our pensions would have been reduced or eliminated a long time ago by the thieves in Springfield.

This amendment, if passed, would be devastating for teachers and public employees.

By: Mark Doyle

HJRCA 49

Teachers have been under attack in Illinois for the past several years. Wealthy interests (Civic Committee of Chicago; Chicago Tribune) and careless/incompetent politicians in Springfield have attached teachers with no real justification. The class warfare being waged is continous and does real damage to the nation. We simply must vote not on this amendment. It has been created to simply give wealthy business interests one more avenune to attack public pensions in Illinois. Public employees are not the problem in this state. Our pensions are small and our contributions to the state are enormous. It is time for the state officials to stand up for the middle class and and working class - the teachers, policemen, firemen, state employees, who make life better for all of us.