Access Living's Annual Report on the CPS Budget

[Editors' Introduction by George N. Schmidt. The following report was presented to the public and Chicago's press on August 24, 2011 and provided to Substance in September in a form we could present on line and in print to our readers. Substance decided to wait weeks to see if any of our colleagues in the media would review, analyze, or even mention it. None has in any detail, let alone in the context of the issues outlined (especially regarding special education services).

While we are presenting this report to the readers of Substance (first on line, an in print in our October edition), we will refrain from commenting or even repeating the significant criticisms the report contains about how CPS produces, presents, and practices its budget except to note two things. The first is that Chicago's ruling class has destroyed most of the groups that once provided the city with independent critical analysis of the CPS budget, leaving behind only a small group of individuals and Access Living. The second is that Access Living's annual analysis is, perforce, focused mainly on special education resources and budgeting, leaving a great deal of the annual CPS budget less than completely analyzed.

Rodney Estvan of Access Living Chicago (above) testified at the August 10, 2011 hearing on the proposed CPS budget at Lane Technical High School, then devoted more than one additional month to preparing the full analysis of the CPS budget that is being made available at Substance today. Substance photo by George N. Schmidt.Because Chicago's corporate rulers — under the aegis of the Chicago Community Trust — have systematically destroyed all of the independent not-for-profit organizations that once did an annual critique of how CPS was presenting its finances and spending its money, Chicago has been left with two organizations — plus Substance and a growing group within the Chicago Teachers Union (that includes some Substance staff — that regularly present an analysis of the CPS budget after what should be careful study.

Rodney Estvan of Access Living Chicago (above) testified at the August 10, 2011 hearing on the proposed CPS budget at Lane Technical High School, then devoted more than one additional month to preparing the full analysis of the CPS budget that is being made available at Substance today. Substance photo by George N. Schmidt.Because Chicago's corporate rulers — under the aegis of the Chicago Community Trust — have systematically destroyed all of the independent not-for-profit organizations that once did an annual critique of how CPS was presenting its finances and spending its money, Chicago has been left with two organizations — plus Substance and a growing group within the Chicago Teachers Union (that includes some Substance staff — that regularly present an analysis of the CPS budget after what should be careful study.

One of those groups, the Civic Federation, had long been a corporate apologist and could not be relied on to present the readers of its annual reports with accurate information, since it would routinely spin the analysis to reflect a corporate party line. Recently, the Civic Federation has issued two reports, both of which are significantly biased and ludicrously inaccurate. In their report on pensions, the Civic Federation furthered the interests of those who want to destroy public worker defined benefit pension plans, virtually ignoring the long and ignominious history of the manipulation of employer contributions by politicians at the state level. The result has been a predictable "Manufactured Crisis."

Laurence Msall and the Civic Federation are routinely quoted in the corporate media of Chicago as "non partisan," but the fact is the Civic Federation's work on municipal finances can be counted on by Chicago's ruling class to routinely provide ammunition for attacks on public workers' rights and public worker unions while defending the imperial power of Chicago's mayor and corporate rulers. Above, at an August press conference, Msall (left) provided some of the cover story for Mayor Rahm Emanuel when the mayor announced that as a result of the TIF Task Force report Emanuel could retain dictatorial control over the vast TIF dollars — while talking about making the program "more transparent." The members of the TIF Task Force provided window dressing for the continuation of the lucrative TIF slush funds, which have provided some of the city's largest corporations with hundreds of millions of dollars under the guise of stimulating "economic development" while shortchanging the schools, parks and others local agencies to which TIF dollars would have been going. Substance photo by George N. Schmidt.All of the public worker defined benefit pension plans in Illinois are underfunded, but to hear the Civic Federation (and its ally, the Civic Committee of the Commercial Club) tell the tale, you'd think it was corrupt workers and not corrupt public agencies that caused the problem. Although the Civic Federation is routinely quoted in Chicago's corporate media at "non partisan," the group's work is carefully crafted and lengthy propaganda for one side of a major debate over tax and budget priorities.

Laurence Msall and the Civic Federation are routinely quoted in the corporate media of Chicago as "non partisan," but the fact is the Civic Federation's work on municipal finances can be counted on by Chicago's ruling class to routinely provide ammunition for attacks on public workers' rights and public worker unions while defending the imperial power of Chicago's mayor and corporate rulers. Above, at an August press conference, Msall (left) provided some of the cover story for Mayor Rahm Emanuel when the mayor announced that as a result of the TIF Task Force report Emanuel could retain dictatorial control over the vast TIF dollars — while talking about making the program "more transparent." The members of the TIF Task Force provided window dressing for the continuation of the lucrative TIF slush funds, which have provided some of the city's largest corporations with hundreds of millions of dollars under the guise of stimulating "economic development" while shortchanging the schools, parks and others local agencies to which TIF dollars would have been going. Substance photo by George N. Schmidt.All of the public worker defined benefit pension plans in Illinois are underfunded, but to hear the Civic Federation (and its ally, the Civic Committee of the Commercial Club) tell the tale, you'd think it was corrupt workers and not corrupt public agencies that caused the problem. Although the Civic Federation is routinely quoted in Chicago's corporate media at "non partisan," the group's work is carefully crafted and lengthy propaganda for one side of a major debate over tax and budget priorities.

The current head of the Civic Federation, Laurence Msall, went to the Civic Federation from the Civic Committee of the Commercial Club. The Civic Federation also recently produced a lengthy and completely useless report on Chicago's charter schools. Based on incomplete information, with shoddy editing and proofreading, the Civic Federation's charter schools report seems to believe that if a document was weighty enough and contains enough footnotes that its "Executive Summary" would simply be passed along as some kind of "non-partisan" truth by the editor's of Chicago's corporate newspapers, and thence to the rest of the media and hence the public. In fact, this is the case, especially for the editors of the powerful Chicago Tribune. Had the Civic Federation's Charter Schools report been submitted to any serious professor as a graduate student exercise in public policy, it would have received an "F" (just as the pension study would have received a "D" for bias).

In this introduction, we do not even begin to review the other major report issued regarding Chicago's public schools by the Civic Federation during the past 12 months, the analysis of the CPS annual budget. Worth noting is that the Civic Federation (a) does not testify at the annual budget hearings of the Chicago Public Schools, (b) no longer presents even a brief summary of its opinions at a meeting of the Chicago Board of Education, and (c) refuses to present its publications to the press in a manner that would allow for serious questions by people who have read the things.

A few weeks after rubber stamping the mayor's power over TIFs, Laurence Msall, representing the supposedly "non-partisan" Civic Federation, took part in the secret "working group meetings" on public pensions held in the conference room of House Speaker Michael Madigan at the Bilandic State of Illinois Office Building at LaSalle and Randolph streets. Above, Msall was taking his proposals for "pension reform" to the discussion on September 16, 2011. The Civic Federation was one of the first groups to push the idea of replacing elected trustees of the pension funds for Chicago public workers with a majority of trustees appointed by Chicago's mayor. A few weeks later, the Civic Federation plan became legislative proposals. Substance photo by George N. Schmidt.But why are the only groups analyzing the budget from the corporate side of Chicago's class conflicts? Isn't there any other systematic point of view? The answer is: Not any longer. By 2011, Chicago's so-called "philanthropists" have wiped out any independent voices critical of the way Chicago's finances are presented and run. The rich have proved "charity begins at home" and they are not about to help fund individuals who look critically at their claims and the claims of their hirelings.

A few weeks after rubber stamping the mayor's power over TIFs, Laurence Msall, representing the supposedly "non-partisan" Civic Federation, took part in the secret "working group meetings" on public pensions held in the conference room of House Speaker Michael Madigan at the Bilandic State of Illinois Office Building at LaSalle and Randolph streets. Above, Msall was taking his proposals for "pension reform" to the discussion on September 16, 2011. The Civic Federation was one of the first groups to push the idea of replacing elected trustees of the pension funds for Chicago public workers with a majority of trustees appointed by Chicago's mayor. A few weeks later, the Civic Federation plan became legislative proposals. Substance photo by George N. Schmidt.But why are the only groups analyzing the budget from the corporate side of Chicago's class conflicts? Isn't there any other systematic point of view? The answer is: Not any longer. By 2011, Chicago's so-called "philanthropists" have wiped out any independent voices critical of the way Chicago's finances are presented and run. The rich have proved "charity begins at home" and they are not about to help fund individuals who look critically at their claims and the claims of their hirelings.

Because of the close relationships between the Daley administration and corporate Chicago's philanthropic centers, for the past decade Chicago, while expending an enormous amount of charitable giving on various causes, has systematically defunded all of the groups that once presented an independent and careful analysis of CPS finances. The results have been disastrous for the city and the schools. In 2010, then Schools CEO Ron Huberman was able to get away with a major lie, viz., that the schools were facing a "deficit" of "$900 million." (In the annual financial report presented to the Board of Education in December 2010, Huberman rounded that lie up to "$1 billion" in an introduction to a document he was already gone from.

By the time the Comprehensive Annual Financial Report (CAFR) was presented to the Chicago Board of Education in December 2010, Huberman had been replaced by Terry Mazany. Mazany was the soft spoken head of the Chicago Community Trust. Mazany had been the hatchet man for corporate Chicago for years, the guy who made sure that Chicago's independent budget analysts were starved of funding and ultimately put out of business. He had built his career bowing to the wishes of City Hall and Arne Duncan. The process was known as "defunding," and Mazany and the Chicago Community Trust turned it into an art as the 21st Century moved forward.

As head of the Chicago Community Trust, Terry Mazany made sure that organizations such as the Neighborhood Capital Budget Group and the Cross City Campaign for Urban School Reform were put out of business through the simple method of "defunding." Both groups, which provided independent and critical budget analysis of CPS finances for years, were critical of the machinations of Mayor Richard M. Daley and CPS CEO Arne Duncan throughout the early years of the 21st Century. Mazany made sure they were starved of philanthropic funding, and by 2007 both groups were out off business. For a brief time during the interregnum between mayors, the ruling class put Mazany in as Chief Executive Officer of Chicago's public schools. Above, Mazany at his first meeting of the school board on December 15, 2010; he served six months until Rahm Emanuel selected Jean-Claude Brizard, who began his time in office on June 2011. After leaving CPS, Mazany returned to the Chicago Community Trust, where he continues to ensure that Chicago's wealthy have their money funneled into projects that will safely preserve and protect corporate power and mayoral control over the schools. Substance photo by George N. Schmidt.It was another wrinkle on what is known nationally as "targeted philanthropy." Those who didn't do the bidding of their corporate masters were simply suffocated, while those who did were funded. The most important groups that were "defunded" in the area of truly independent education budget analysis were the Cross City Campaign and Neighborhood Capital Budget Group. By stopping the flow of dollars to (most notably) the Neighborhood Capital Budget Group (NCBG) and the Cross City Campaign for Urban School Reform, Mazany helped guarantee that a Big Lie — such as the one he allowed Huberman to pass along to the Board of Education in December 2010 in the form of the CAFR for FY 2010 — would go unchallenged. And indeed it was with irony that Substance reporters at the Chicago Board of Education noticed it was Mazany who was the CEO (albeit "interim") of CPS in December 2010 when the first iteration of Huberman's ridiculous "billion dollar deficit" fiction was passed along to the Board.

As head of the Chicago Community Trust, Terry Mazany made sure that organizations such as the Neighborhood Capital Budget Group and the Cross City Campaign for Urban School Reform were put out of business through the simple method of "defunding." Both groups, which provided independent and critical budget analysis of CPS finances for years, were critical of the machinations of Mayor Richard M. Daley and CPS CEO Arne Duncan throughout the early years of the 21st Century. Mazany made sure they were starved of philanthropic funding, and by 2007 both groups were out off business. For a brief time during the interregnum between mayors, the ruling class put Mazany in as Chief Executive Officer of Chicago's public schools. Above, Mazany at his first meeting of the school board on December 15, 2010; he served six months until Rahm Emanuel selected Jean-Claude Brizard, who began his time in office on June 2011. After leaving CPS, Mazany returned to the Chicago Community Trust, where he continues to ensure that Chicago's wealthy have their money funneled into projects that will safely preserve and protect corporate power and mayoral control over the schools. Substance photo by George N. Schmidt.It was another wrinkle on what is known nationally as "targeted philanthropy." Those who didn't do the bidding of their corporate masters were simply suffocated, while those who did were funded. The most important groups that were "defunded" in the area of truly independent education budget analysis were the Cross City Campaign and Neighborhood Capital Budget Group. By stopping the flow of dollars to (most notably) the Neighborhood Capital Budget Group (NCBG) and the Cross City Campaign for Urban School Reform, Mazany helped guarantee that a Big Lie — such as the one he allowed Huberman to pass along to the Board of Education in December 2010 in the form of the CAFR for FY 2010 — would go unchallenged. And indeed it was with irony that Substance reporters at the Chicago Board of Education noticed it was Mazany who was the CEO (albeit "interim") of CPS in December 2010 when the first iteration of Huberman's ridiculous "billion dollar deficit" fiction was passed along to the Board.

As a result of the defunding of the truly independent groups, one of the few lengthy and detailed studies of the CPS annual budget to be available to the public every year, and with consistency, comes from Access Living Chicago. A problem is that Access Living is focused on disability rights and special education services. As a result, although the analysis they present is comprehensive, their focus is of necessity narrow. But at least the funding for Access Living, based as it is on its vast number of programs for the disabled, can't be choked off like the funding for Neighborhood Capital Budget Group and the Cross City Campaign were (to cite just two).

It is with this history and reality in mind that Substance presents its readers with the analysis of the CPS budget from Access Living. Thanks to the staff at Access Living and to Rodney Estvan for permission to reprint this document in full. ]

ACCESS LIVING ANNUAL BUDGET REPORT ON CHICAGO PUBLIC SCHOOLS

By Rodney Estvan

Introduction

Access Living again had great difficulty carrying out a review of the CPS budget this year because of missing components of the proposed budget. Given what there was to work with in this budget we draw the following conclusions in this review:

● The property tax increase CPS projects in its proposed budget is needed based on expected revenues and the costs of educating over 400,000 students and 50,000 students with disabilities.

● The idea in the budget of creating a multi-year budget projection was a good one, but the first attempt at creating one was not effective.

● Projected increases of special education staff in schools was a positive development, but we remain skeptical if these positions will materialize.

● CPS needs to begin to take steps to move some students with disabilities in elementary school settings to a Universal Design special education service delivery system that we discuss in this review. We believe this model would be better for some students and would cost less.

● The budget lacked even reasonable estimates on the number and location of staff employed by CPS.

● One of the big cost reductions in the budget is a proposal to eliminate administrative regions and create larger networks for middle management purposes which purports to save $32 million (page ii of FY12 budget). The problem is that in the budget detail called the segment reports there are no new network budgets to compare to the areas budgets. All that exists in these reports are the budgets for the old areas and there can be no verification of the cost saving claims in this area.

● We do not think that the proposed cuts in the area of Response to Intervention are a wise decision given the ISBE mandate in this area. Access Living would be happy to work with CPS in a lobbying effort to amend the existing regulations in this area to allow for more flexible implementation of RTI.

● There was no discussion in the budget of additional payments being made by CPS to the Chicago Police Department (CPD). The original intergovernmental agreement between CPS and the CPD and then Mayor Daley was to pay $32.8 million for these services for a period time from 2009 through 2012, on July 27, 2011 CPS agreed to increase this budget to $102.8 million (see Board Report 11-0727-PR18). The CPS even agreed to make back payments to the CPD reported to be $46 million. CPS went from paying about 8 million a year to the CPD to $25.5 million with one vote. This decision added to the CPS's fiscal problems and did not have to be made because the agreement CPS made with the CPD under the Daley administration did not provide for this cost escalation.

● We note the continuation of ADA Capital Improvements to make more CPS schools accessible to community members, teachers, and students with disabilities who need physical accessibility to schools. The idea that CPS will create a 10-year Facility Master Plan makes sense and will allow for CPS to be more strategic in planning out which schools will receive funding for ADA Improvements.

● The CPS Board of Education's budget subcommittee is not being effectively used in the budget development process and should play a bigger role.

● CPS seems to be having significant problems with projecting enrollment in its schools and its methodology for such projections in unclear.

This review concludes with a number of recommendations.

Section I : FY 2012 Education Budget and the big change at city hall.

On September 7, 2010 Mayor Daley announced not he would not seek a seventh term as Mayor of the City of Chicago. Mayor Daley had complete authority under the Illinois School Code since 1995 to appoint the Board of Education and effectively pick the Chief Executive Officer of the Chicago Public Schools (CPS), so for the school district this announcement was earth shaking. On October 3, 2010 Rahm Emanuel formally announced his candidacy for Mayor and quickly became the front runner in the election to replace Daley. Emanuel was elected Mayor of Chicago, easily overwhelming five rivals in February 2011 and took office in May. The Board of Education was replaced: Jean-Claude Brizard became the new CEO and Dr. Noemi Donoso became the new Chief Education Officer. The CPS budget office was left alone with Diana Ferguson the CFO retained in her position. Ferguson shortly thereafter resigned, and the CPS budget director Christina Herzog was also no longer employed at CPS by July 2011. In the normal budget cycle the budget is largely completed by May, in this situation a largely new team took control over the budget process very late in the development process.

This transition created some inconsistencies such as confused enrollment data for some schools and missing units from the Oracle database reports that supplement the primary budget document. However, even with these problems the budget gives the public picture of the fiscal distress CPS is currently under with its $5.1 billion budget.

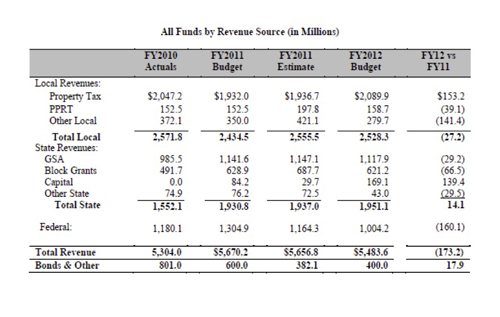

The budget shows that revenues are declining by $173.2 million in FY2012 compared to FY2011.

Table One. CPS provides in Table I (left) data to demonstrate this decline in revenue.

Table One. CPS provides in Table I (left) data to demonstrate this decline in revenue.

The revenue line includes a projection of about $2.1 billion in property tax receipts, which is inclusive of additional revenue coming from an increase in property taxes of 2.7%. We will discuss in depth the issue of the property tax increase in a later section of this report. It is important to note that because the method in which property taxes are collected the time frame they operate under is not consistent with the fiscal year under which CPS operates. But because of the Great Recession the base property tax receipts before the rate increase for CPS were projected to increase only by $45.2 million or a 2% increase in receipts from FY 2011.

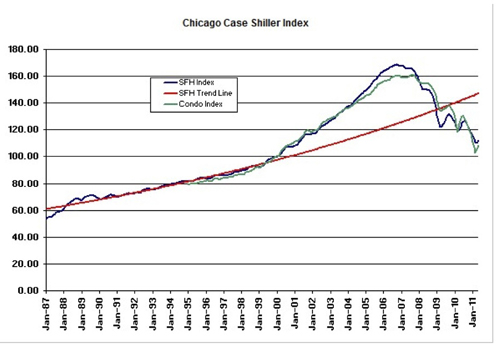

The projected FY 2012 percentage of natural increase in tax receipts, before the rate increase, can be compared to prior years by using data from the CPS Comprehensive Annual Financial Report (CAFR). For a comparison we used the receipt increases between 2001 and 2002, then the increase between 2004 and 2005. Using these two comparisons, we find that tax receipts grew between 6 and 4 percent per year more or less naturally. So a natural receipt increase rate of only 2% represents a major deterioration from times when the economy was hotter. The Case-Shiller Home Price Index for Chicago provides a measure of single family homes and condos prices over time. Rather than using the median sales prices often reported in the media, this index actually follows the changes in prices of individual homes and condos over time.

The Case Shiller Index shows the impact of the bursting of the Housing Bubble on Chicago home and condo values. The chart to the left runs from January 1987 to February, 2011 and includes a trend line, it is denominated in thousands of dollars. The chart graphically demonstrates the collapse in home values Chicago has experienced. Chart I is the Chicago Case Shiller Index

The Case Shiller Index shows the impact of the bursting of the Housing Bubble on Chicago home and condo values. The chart to the left runs from January 1987 to February, 2011 and includes a trend line, it is denominated in thousands of dollars. The chart graphically demonstrates the collapse in home values Chicago has experienced. Chart I is the Chicago Case Shiller Index

Commercial real estate values in Chicago have also declined significantly and some major properties have gone into foreclosure. The CPS Table I from the current budget we have reproduced gives only the more recent numbers for state revenue to CPS, the most current CPS Comprehensive Annual Financial Report provides state revenue data going back to 2001. From 2001 to 2010 the average yearly increase in state aid going to CPS yearly was 1.96%. As can be seen from the CPS Table I from 2010 to the estimated state revenue received for 2011 CPS got a 24.8% increase in state aid. This is due to delays in payments and is explained in the budget.

Over the long run it seems safe to assume an average increase in total state aid to CPS running around 2% a year. But state aid is in part categorical in its nature and can't be used flexibly by CPS to fund the school district. Because of the aberration of Federal funding for CPS coming from the American Recovery and Reinvestment Act of 2009 (ARRA) starting in FY2010 it is best not to look at Federal funds coming to CPS past 2008 in order to estimate an average yearly increase in this aid. Again for a data source we use the most current CPS Comprehensive Annual Financial Report. From 2001 to 2008, the average yearly increase in Federal funds coming to CPS was 5.9%.

We compare this array of revenue sources and their average yearly increase to the increase in the CPS total expenditures from year to year. From 2001 to 2010 the average yearly increase in CPS total expenditures was 4.38%, based on audited expenditures. In 2001 CPS was spending $4.07 billion and by 2010 it was spending $5.9 billion. CPS basically was increasing its spending for years based on the average increases in its various revenue sources and then came the Great Recession.

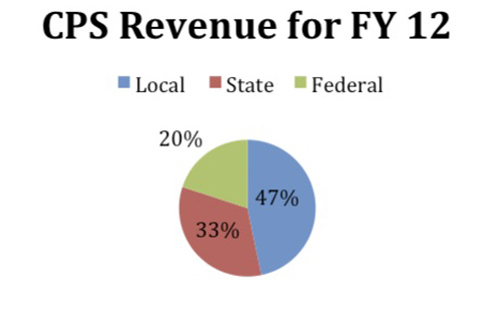

CPS revenue.In the pie chart (Chart II) to the left we can see the projected revenue for FY12 by its source. Chart II CPS Revenue

CPS revenue.In the pie chart (Chart II) to the left we can see the projected revenue for FY12 by its source. Chart II CPS Revenue

Currently local funds made up of property tax receipts, Personal Property Replacement Tax (PPRT), and other smaller pots of money, make up the largest single revenue source for CPS. Historically, state funding for CPS made up a greater proportion of overall revenues than is projected in the FY 12 budget. Because of the fiscal crisis of the State of Illinois, CPS and other districts in Illinois have become more dependent on their own property tax base to educate students. This has led many school districts in Illinois to hoard funds because in addition to the instability of State funding districts are expecting an actual decline in tax receipts due to dropping home values.

Chicago has not been able to do this and it has been forced to use its reserve funds. The depletion of the CPS fund balance in FY2011, because of delays in state payments which we discussed in last year's review, and late receipt of property taxes, forced CPS to use tax anticipation notes in FY2011. If CPS had not done this, it would not have been able to make its payroll in November of 2010.

Access Living last year believed CPS needed to raise property taxes, and it did not. This year CPS did increase property taxes and Access Living supports CPS in making that decision. Students with disabilities because of the services they require can be expensive for school districts. CPS has a few schools where per pupil costs for these disabled student are as high as $32,000 per year, and students placed in the private sector can be far more expensive than that. In order to provide these services which CPS is legally mandated to provide the district needs money.

Property taxes in Cook County are more complex than in any other county in the State and the Civic Federation wrote a 43-page report attempting to explain the county's complex process. Cook County is the only county in the State of Illinois that sets different property tax assessment levels for different types of property. Cook County has 5 different major classifications of property and 8 "incentive classes." Therefore, in Chicago real property is valued for the purpose of property taxation at many different percentages of their fair cash values. Given how our taxes are collected and how complex Chicago's property tax collection system is, it is not surprising many citizens expressed opposition to CPS's rate increase.

The proposed CPS FY 12 budget draws a very negative outlook for the fiscal future of the school district writing:

"The picture over the next three years continues to be bleak. Our revenues are likely to be nearly flat, with little likelihood for state or federal increases. Expenditures for pension contributions and debt service will grow in future years. Even under the most conservative case—no increases in expenditures other than for pensions and debt service—the end of year deficit will reach nearly $1 billion within 2 years."

We believe that CPS made a major strategic error in way it spent the ARRA funding it received from the Federal government that created a predictable funding cliff. We will discuss this at length in this review. We agree with CPS's attempt to provide a multi-year view of the district’s estimated revenues and major spending areas. But we believe this first attempt was relatively unsophisticated, and we devote a section of this review to this important issue. We also return to the issue of TIFs which we have taken up in the past because of the number of comments relating to this process made at CPS budget hearings.

Section II: Proposed FY 2012 budget

The FY2012 budget increases funding directed towards special education services by $22.6million. CPS was required to spend millions more from its general fund for special education services to replace a $71.3 million reduction in federal special education funding due to the ending of ARRA In FY 95 CPS's total cost for special education was $336.7 million and in FY 12 it will be $911.5 million, a growth of about 170%. In FY 2012 special education expenditures will compose 16.51% of non capital appropriations; in FY 96 special education composed 17.19% of non-capital budget appropriations. During the same time, the total non-capital budget for CPS has grown from $2.7 billion in FY96 to $5.5 billion in FY 12 or 103%. Access Living has noted in past reviews of CPS budgets, that the Chicago Board of Education should re-establish a budget or audit subcommittee. On July 26th 1995, the Board suspended its own rule requiring a standing budget committee. The Board we believed needed to have a standing finance oversight or audit committee, just as publicly held corporations do. The CPS is one of the largest employers in Illinois and its fiscal issues are extremely complex, requiring budget or audit committee meetings that are subject to our state’s Open Meetings Act. Decisions such as utilizing the stabilization fund or defining a fiscal emergency should be discussed publicly in a budget committee and then brought to the full Board for final approval. The CPS agreed to re-establish a budget audit committee of the Board in 2010. Since then we have not seen one deep public discussion in this committee on cost control, budget reductions appear all to have been decided between May and the end of July by the executive leadership of CPS without subcommittee committee approval.

The average CPS teacher’s salary, according to the Illinois State Board of Education, has gone from $53,238 in 2002, to $74,839 in 2008, and back down to $68,079 in 20010. This was the case even though the average CPS teacher in 2002 had 13.9 years of teaching experience and 12.9 years by 2010. As experience has gone down, the percentage of teachers with graduate degrees has gone up. By 2010, 59.9% of CPS teachers had graduate degrees whereas in 2002 only 43.8% held graduate degrees. In FY 2012 the total amount of compensation for all special education staff working in traditional CPS elementary and high schools was projected to be $542.7million or $ 27.3 million more than in FY 2010. This was the case even though CPS eliminated a scheduled 4% pay increase for collective bargaining unit unions because of the district’s financial state and contractual provisions that allowed for such actions.

The FY2010 budget also stated CPS had fewer teachers than in FY09. From FY09 to FY2010 there was a 3.4% decline in “teacher class positions.” In FY 2011 CPS projected to have fewer teachers with a decline of 6.1% in total teaching positions. However, the FY 12 CPS budget book in the section titled "Budget Overview" does not give the total number of teaching positions in CPS. It states instead: "Our teaching force will be 21,000 strong, supported by 469 principals." Based on this statement one would be led to believe that CPS eliminated 109 principal positions in one year, we have a hard time believing that is correct.

The section of the FY 2011 budget where total teaching positions were listed titled "expenditure analysis" is missing in the FY 12 budget. Table II below appeared on page 90 of the FY 2011 budget and no comparable table existing in the FY 12 budget. We have asked CPS for an update to this table but as of Monday August 22nd we have yet to receive it. The Civic Federation of Chicago also noted this issue stating:

Information on CPS personnel by location and type (administrative, school-based and capital fund positions) was not provided in the FY2012 budget. Information on the number of teachers, administrators and support staff is crucial data that should be presented clearly in the annual budget document. Table II FY 11 CPS Position summary

It is possible to compare the number of schools in CPS in FY 11 to those projected for FY 12. In FY 11 CPS indicate there would be 528 elementary schools and 152 high schools in the system. The FY 12 budget projects 528 elementary schools and 149 high schools. A more detailed examination of the proposed FY 12 budget reveals that 5 neighborhood elementary schools are eliminated, 4 charter elementary schools are added, and one selective enrollment elementary school is also added. At the high school level 5 small high schools are eliminated, 1 citywide high school was eliminated, 1 achievement academy was eliminated, 1 alternative school was eliminated, the number of high schools listed as neighborhood increased by 4, and 1 new contract high school was added. The FY 2011 and FY 2012 budgets give projected enrollments for all CPS charter and contract schools including for the percentage of students with disabilities. Using this data we were able to determine that CPS projected for FY 2011 that there would be 44,636 charter and contract school students and 4,918 would have disabilities or about 11%, In FY 2012 CPS projects 50,284 students enrolled in charter and contract schools and 5,875 would have identified disabilities, or about 11.7%. This compares to the district wide average of about 13% for traditional schools.

In April 2009 Access Living released its report Renaissance 2010 and Students with Disabilities. Access Living found that charters and contract schools as a group were no more effective in teaching students with disabilities than the average CPS school. Using data for charter schools and contract schools from June 2008 we can see that in about four years these schools went from having 1,216 students with disabilities to the projected FY 12 enrollment of 5,875. Specialized Services Unit 11670 once contained charter schools support services staff, which consisted of 22 CPS special education teachers who were CPS employees assigned full time to various charter schools. The projected cost in FY 2010 for just these 22 teachers was $1.7 million. According the last Renaissance 2010 RFP the CPS policy of providing CPS employees who certified special education teachers to charter schools ended and all reimbursement to charters for these teachers is now done on a per-teacher basis the formula for which can be found in the FY 2012 budget at pages 256-257. All 22 of these positions were eliminated in the FY 2011 budget. Special education costs to reimburse charter schools for special education teachers, aides, and other necessary costs in FY 12 was not fully documented in the CPS FY 12 budget in the section "FY 2012 Schools At A Glance" because many charter schools listed special education funding at "$0" yet had numerous special education students. Specialized Services Unit 11670 in the FY 12 budget grew overall by 6 positions increasing from 171.500 to 177.500 positions. It appeared that some of the positions added may have been transferred from Area 27 the special education schools area office which according to the budget appears to be closing. It should also be noted that there were significant staff reductions in the special education office overseeing improvement of instruction with a 22% reduction of staff in that particular subunit.

Citywide special education unit 11675 is a very major link in bringing services where they are needed in the city and it is a large administrative unit which in FY 2008 had 1,710.5 positions. This unit had 41.5 positions were eliminated in the FY 11 budget. Including 20 school psychologists, all behavioral disability specialists, all members of the CPS positive behavioral intervention program, and 11 school nurses. CPS added 24 staff to a new early childhood special education unit. In the FY 12 budget unit 11675 was reduced yet again by 82.5 positions. Among the notable positions reductions were 10 hearing and vision screening technicians, 21 speech/language pathologists, 19 school social workers, 10 school psychologists, and 4 school nurses. From 2008 to the FY 2012 budget this unit has lost 224 positions or a reduction of 13% in four years. The CPS central office unit for special education, unit 11610, was reduced by 7 positions in FY 11 to a total of only 37 staff. In FY 12 this unit was reduced by one more position and now has only 36 staff. This unit in FY96 had 120 positions; in the FY09 budget it had only 46 positions. By FY 2010 this unit had 44 positions. In six years this unit has lost 70% of its staff and it is legally responsible for assuring that services are provided to almost fifty thousand students with disabilities in CPS.

The FY 2011 budget states CPS was projected to have 3,356 special education teachers in traditional CPS schools. There was not a comparable projection in this year's budget. Last year in Access Living's budget review in order to determine the position reductions we examined the CPS Oracle reports for the primary school based units 19092, 19096, 19097, and 19098 in relation to "special education teachers." Using this data we concluded in FY 2011 that CPS reduced special education teachers in traditional schools by a total of 31.4 positions. CPS added a total of 19 positions at the elementary school level, reduced positions in high schools and vocational schools, and eliminated positions in the special schools by the closing of one school. In June 2010, CPS announced it was going to layoff around 400 teachers in what are called the track E schools or schools with a year-round calendar. The CPS and the CTU went into litigation over these layoffs and future layoffs. As part of that litigation the union filed a list of the teachers who were cut from the track E schools including their job description. Using this information we could determine that 26 special education teachers were cut from the E Track schools. The total teacher reductions from these schools was 426, hence the special education reduction was about 6% of this total. In most cases these teachers were laid off for declines in special education enrollment, in a few cases these teachers were laid off because the principal had reallocated funds, and in even fewer cases there were what were called "program reductions" or "redefinition" of the position. The issue of positions relating to possible reductions in special education aides and other special education classroom based support staff is far more complex than for special education teachers because of the many different job titles used by CPS. As best as we can determine the number of classroom aides of various types increased significantly in traditional schools in FY 11 by over 300 positions. The only category we could detect a decline in was in the job category of "child welfare attendant." Based on this increase in aides we would say that CPS restored in FY 2011 almost all of the 745 special education aide positions CPS cut in June 2006. For the FY 12 budget we again reviewed special education teacher positions in the primary school based units 19092, 19096, 19097, and 19098. But we had no overall statement from CPS on the number of special education teachers in the system. There were special education teacher reductions in CPS special education schools and general high schools. But there was a significant increase in special education teacher positions in traditional CPS elementary schools. Overall the FY 12 budget presented an increase of 67 special education teacher positions. As is always the case the situation of special education paraprofessionals in schools is complex. In order to simplify this analysis we have only examined four types of aides working in schools whose positions are covered by units 19092, 19096, 19097, and 19098. Including Children's Welfare Attendants, School Bus Aides, Special Education Classroom Assistant, and Special Education Classroom Assistant type II. Looking at just these positions, which are not all full time, we saw an increase of 331.5 positions which did not appear to possible given annotatable information Access Living has been receiving from schools and parents. Section III: Preliminary Multi-Year Budget Review

CPS in this budget began to develop a multiyear budget projection which we believe is very important and needs to be expanded in the years to come. We also believe that this projected multi-year budget needs to be the subject of very serious examination by the Board's budget committee. The multiyear budget should in the future be developed during the school year and it should be based on the type of budget projecting techniques utilized by the Congressional Budget Office. The multiyear budget projection document needs to provide the public with at least two scenarios that embody different assumptions about future revenues and spending at CPS. There are now financial forecasting software packages available that can help greatly with this process. In Michigan there is a package called Dynamic Budget Projections© that provides multi-year budget projections in an Excel template. The ability to create multiple "what ifs" allows a school district to present different scenarios. The multiyear budget projection document presented in the CPS FY 12 budget report is fundamentally a static estimate approach assumes that the revenue base does not change in response to a changes in the demographics of Chicago, the property values within the city, federal and state funding policy changes, and possible changes to existing TIF districts. A cursory analysis of the 21 inputs of the CPS multi-year budget review indicates that 13 of the 21 inputs are static generally stating "Flat FY2012-FY2015" or no change. If one examines the actual history of CPS budget going back any time at all one realizes that these assumptions are extremely unlikely. CPS needs to present to the public a dynamic budget projection document. The public needs to give inputs on goals relating to this document and it probably should be done in January. It would need to be adjusted every year.

Section III: Tax increment financing districts and the CPS budget

The issue of property tax dollars lost to the Chicago Public Schools has become a big issue during the current CPS budget cycle and several speakers at CPS budget hearings made repeated references to this issue. Ben Joravsky of for the Chicago Reader has been the city's leading voice questioning the loss of dollars to CPS because of TIF districts. Tax increment financing and money lost to schools is a major topic on the web site of Progress Illinois. The leadership of the Chicago Teachers Union has criticized money lost to CPS from TIF districts in Chicago. A parent group in Chicago called Raise Your Hand, has criticized TIFs as taking money away from schools. The CPS FY 12 budget contained $140 million of surplus TIF proceeds that CPS indicated were not anticipated in the FY2011 budget. CPS had originally expected that only $50 million would be received in FY2011, with the balance of $90 million in FY2012. However, received CPS $123 million in FY2011 and have budgeted the remaining $16 million in FY2012.

New schools were also built using TIF revenues, one such project currently was the Back of the Yards Area High School which generated some conflict between aldermen whose wards crossed the TIF district used to fund the project. But as Mr. Joravsky has argued:

Roughly half the new tax revenue that flows into TIF districts would otherwise have gone to the schools. In essence CPS is giving up at least $250 million a year and then, to compensate, raising taxes, cutting programs for students, and begging Daley to give some of the money back. For example, from 2007 through 2013 about $1.5 billion in property tax money that would have gone to the schools will instead be diverted into TIF accounts. Through the Modern Schools program, the mayor has promised to spend about $600 million on school construction and rehab. In short, they give him a dime and he gives them a nickel. Only a chump would consider this a good deal. TIFs exist because of State law, specifically the Illinois’ Tax Increment Allocation Redevelopment Act . Simply this Act authorizes that TIF funds may be used for: The administration of a TIF redevelopment project. Property acquisition. Rehabilitation or renovation of existing public or private buildings. Construction of public works or improvements. Job training. Relocation. Financing costs, including interest assistance. Studies, surveys and plans. Marketing sites within the TIF. Professional services, such as architectural, engineering, legal, and financial planning.

The state law as it currently exists is in part because of an extremely powerful lobbying organization called the Illinois Tax Increment Association (ITIA). Among the Board members of ITIA are Philip R. McKenna, President Kane, McKenna & Associates, lead partners of several important law firms, mayors or village board presidents of 14 Illinois towns, and officers from the Investment Banking sector. There is no representation of school districts on the board of this body. The ITIA explains the theory of TIFs to the public this way:

When a TIF redevelopment project area (often called a TIF district) is created, the value of the property in the area is established as the “base” amount. The property taxes paid on this base amount continue to go to the various taxing bodies as they always had, with the amount of this revenue declining only if the base declines (something that the TIF is expected to keep from happening) or the tax rate goes down. It is the growth of the value of the property over the base that generates the tax increment. This increment is collected into a special fund (the Special Tax Increment Allocation Fund) for use by the municipality to make additional investments in the TIF project area. This reinvestment generates additional growth in property value, which results in even more revenue growth for reinvestment.

It is the growth in revenue based on an increase in the value of the property over the base that CPS loses in the creation of a TIF district. According to the 2010 CPS Comprehensive Annual Financial Report there were about 172 TIF districts within the taxing area of CPS. When each of these TIF districts were created the CPS had a seat on the Joint Review Board for each of these TIF districts, there is no record of CPS objecting to the creation of any of these TIF districts. CPS does not have veto power in the Joint Review Board process. Moreover, Joint Review Board decisions according to the Act: "shall be an advisory, non -binding recommendation. The recommendation shall be adopted by a majority of those members present and voting. The recommendations shall be submitted to the municipality within 30 days after convening of the board."

The CPS however does have the legal right to defend its tax base against the creation or continuation of a TIF district within its taxing area. Oak Park and River Forest High School District 200 did just that in February 2010 suing the Village of Oak Park over loss of property tax dollars from Greater Mall Tax Increment Redevelopment Area which was being extended beyond its original life of 23 years. CPS cannot, just get out, of existing TIFs state law as does not provide for an individual taxing body such as CPS within a municipality to unilaterally exit a TIF and take their money without litigation. Illinois TIF law allows a TIF district to exist for a maximum of 23 years, which can be extended by legislative action. Any TIF district in the City of Chicago may be terminated earlier if all financial obligations are paid-off and the Chicago City Council votes to terminate the district. Since 1977, when Tax Increment Financing was enacted, about 30 TIF districts in Illinois have been voluntarily terminated by their municipal sponsors. Aside from litigation there is the possibility that excess funds currently in Chicago's TIF districts could legally be returned to CPS as happened in FY 2011 and will happen FY 2012. Legally the Chicago City Council could release millions of dollars of surplus funds to CPS again immediately. According to the City of Chicago in 2009 158 TIF districts inside of Chicago had unspent revenue from previous years that were not required for debt service. Using the City of Chicago's own information it is possible to estimate that about $343 million would be available to be released to the various taxing bodies within the City of Chicago. Based on the current distribution of property tax dollars within the City of Chicago, the CPS would under any release program be eligible for about 50% of these funds or about $171.5 million on a one time basis. The Chicago Sun Times provided another estimate of City TIF fund balances using a of Deloitte & Touche audit that indicated at the end of 2009 there was $1.162 billion in "uncommitted" TIF funds, using this figure there would be $581 million that could be made available to CPS on a one time basis. A story in the Tribune that ran the day following the Sun Times story indicated that a more current TIF fund balance might have about $350 million in uncommitted TIF funds that could be made available to CPS on a one time basis. Therefore a real question is why did CPS receive only $140 million of surplus TIF proceeds which is lower than most estimates of what CPS should receive in uncommitted TIF funds? In the Illinois General Assembly SB 1990, sponsored by Sen. Michael Noland (D-Elgin) in 2009, would have imposed requirements for an annual TIF project budget and goals review by a locally chosen panel of citizens. It would have required any annual revenue in excess of the budget for a TIF project area would have to be returned to the affected taxing districts each year, including school districts. SB 1990 would have further provided that the redevelopment project areas for a TIF would have to be approved by a majority vote of each county board and the governing authorities of the other overlying taxing districts, including school districts. SB 1990 was effectively blocked in 2009 by the powerful TIF lobbying group ITIA and could not get out of the Revenue Subcommittee on Property Taxes whose chairman was Senator James Meeks. The Chicago Public Schools belong to the Illinois Association of School Boards (IASB) and a member of the CPS Board of Education has historically been an officer of that organization. The IASB has gone on record as supporting the recommendations of Government Finance Officers Association (GFOA) on the use of TIFs. One of GFOA's recommendations reads:

The economic benefit to the local economy, the fiscal impacts to the affected government(s), and

overlapping tax entities, such as school districts, and the economic cost of TIF district incentives should be analyzed and subjected to various sensitivity analyses.

No member of the CPS Board of Education either past or present has ever requested any type of fiscal impact study on any proposed TIF within the taxing limits of CPS. But even the release of all uncommitted TIF funds do not solve CPS budget problems. The Civic Federation in its report on the CPS FY 12 budget indicated that more information should be provided to the public on TIFs in the budget and we completely agree.

Section IV: Response to Intervention and CPS The FY 2011 budget contains a discussion of CPS implementation of the Response to Intervention (rti) framework. CPS is required by Illinois 'special education rules to use an RtI process as part of the evaluation procedures to identify students with learning disabilities in the 2010-2011 school year. The CPS discussed this student intervention system in the FY 2011 budget as follows:

In addition to focusing on teacher quality, in FY2011 CPS will invest in efforts to increase

student performance through the Response to Intervention (RtI) Framework. RtI is a framework for continuous improvement that is based on the principle that all children can learn. The RtI framework utilizes a multi-tiered approach to intervention as well as scientific, research-based educational resources (e.g., curricula), high quality instructional practices, and data-driven decision-making to improve education for all students.

Student performance information is used to guide instructional decisions at the classroom level and to identify students who are struggling. The RtI framework seeks to identify students who may be at risk and require intervention; as a result, specific interventions are incorporated that enable teachers to respond to student needs before their struggles worsen. School principals and Chief Area Officers have been provided a menu of options for intervention materials, professional development, and support services that they can use to meet the needs of struggling students.

The goal of RtI is to ensure that all students who are not achieving at the expected rates in reading and mathematics have access to support. It is estimated that schools will spend approximately $45 million on instructional materials and professional development within their FY2011 allocations; CPS will spend an additional $10 million in FY2011 on support services for students who require more specific intervention. CPS in FY 11 required schools themselves to find $45 million out of their existing budgets for "instructional materials and professional development." But in the PowerPoint presentation CPS provided along with its budget FY 12 document it stated it intended to "reduce various citywide programs including: Response to Intervention stipend." After the hype in support of RtI it is less than clear why CPS made this decision.

The documentation process for RtI is extensive, requiring progress monitoring, charting, and continuous real time monitoring of students undergoing interventions. These interventions are not the responsibility of special education teachers, but primarily the students' regular education teachers. The overall implementation of RtI in FY 11 was the responsibility of the CPS Office of Teaching and Learning. It is now unclear if that still is the case. Access Living has been heavily involved with the attempts of the Illinois State Board of Education to implement RtI for four and a half years. In February 2006, the Illinois State Board of Education (ISBE) presented its proposed amendments to Part 226 of the Illinois State Administrative Code. These regulations were required to be revised because of the reauthorization of IDEA. The revised IDEA made major changes as to how Learning Disabilities (LD) were to be identified by schools. The changes in LD assessment are complex and were strongly objected to by some special education professionals at the school level. The proposed ISBE special education regulations were rewritten in a streamlined form that was not understandable to parents or for that matter to special education teachers. On July 25, 2006 Access Living submitted written comments to the ISBE on its proposed amendments to Part 226 of the Illinois State Administrative Code. Our initial review was 18 pages long and covered numerous aspects of the proposed regulations. On August 3rd U.S. Secretary of Education Margaret Spellings released the new regulations for Part B of the Individuals with Disabilities Education Act. On August 8, 2006 we supplemented these original comments with an additional statement to the ISBE at a public hearing held in Springfield Illinois. We again commented on September 12, 2006 at a public hearing held in Chicago on the proposed 226 regulations. On December 14th we again spoke before ISBE before their vote on these regulations which went before the State Legislature’ Joint Committee on Regulations (JCAR). Access Living along with many other advocacy organizations, in particular the Learning Disabilities Association of Illinois and ISELA - Illinois Special Education Coalition, effective froze ISBE's rules in the committee but eventually they passed .

On June 14, 2007 the Illinois Superintendent of Schools Dr. Christopher Koch invited a number of the stakeholders in relation to our State special education rules to a meeting. Among those attending this meeting either in person or by phone were representatives from the Illinois Federation of Teachers, Illinois Education Association, the chair of the Illinois Special Education Coalition (ISELA), Family Resource Center on Disability (FRCD), Designs for Change (DFC), Access Living of Chicago (AL), Illinois State Advisory Council on the Education of Children with Disabilities, the Learning Disabilities Association of Illinois (LDA-I) and associations representing Special Education Administrators.

Four of these stakeholders, ISELA, FRCD, DFC, and AL agreed on a proposal to the State Superintendent for specific alternative language for the two sections of the Special Education rules that the Joint Committee on Administrative Rules (JCAR) of the Illinois General Assembly had at the time under a filing prohibition. In relation to RtI among the things we proposed was that there be a twelve-week maximum for the implementation of scientific, research-based interventions if students were not demonstrating academic progress (after which the district would be obligated to seek parental consent for a full case study evaluation). We also requested that the implementation time line for requiring school districts to implement RtI be delayed. All of these modifications were rejected by ISBE.

ISBE began to implement RtI by using a federally funded pilot program called Illinois ASPIRE, CPS had schools in the pilot program . Access Living using the Illinois FOIA law requested information from CPS on for an important outcome of the RtI program, that fewer students would need to be referred for special education evaluations at these schools based on the improvement shown due to the RtI process. The CPS provided initial referral rate data going back to FY 2003 and going forward to FY 2009 after these schools having implemented RtI. The table below was provided to Access Living by CPS.

Table III CPS referral rate for ASPIRE schools

The CPS as part of the FOIA request also provided city wide initial referral rates for the same fiscal years. These can be seen in the table below. CPS Citywide initial referral rates

1.93% 1.89% 1.84% 1.66% 1.73% 1.43% 1.56%

Table IV CPS Citywide referral rates

Overall we could not discern any pattern of reduction in the initial referral rates for these six CPS ASPIRE schools. In fact by 2009 of the six schools half were higher than the citywide average for schools which were not yet implementing RtI. Reports looking at implementation of RtI through the ASPIRE program statewide issued for the 2006-2007, and 2007-2008 school years by the Center for School Evaluation Intervention and Training at Loyola University of Chicago do not show the RtI program to be working up to expectations with even the higher level of support provided to the ASPIRE program through the federal grant. We do not think that the proposed cuts in the area of Response to Intervention are a wise decision given the ISBE mandate in this area. We have major doubts about the effectiveness of RtI in reducing referral rates. Access Living would be happy to work with CPS in a lobbying effort to amend the existing regulations in this area to allow for more flexible implementation of RTI along the lines we and other advocacy groups proposed several years ago.

Section V: Problems with demographic analysis

The Civic Federation in its review of the FY 12 CPS budget pointed to the recent declines in CPS enrollment. The Federation notes in its review:

[CPS] total actual enrollment rose by 1,324 students between fall 2007 and fall 2008. It then dropped by 708 students between school years 2008 to 2009 and even more significantly, by 5,890 students, between the 2009 and 2010 school years. To put it simply CPS has consistently failed to correctly analyze enrollment trends. Below is the a table from the CPS FY 11 budget on projected enrollment.

Table V CPS enrollment projection FY 11 budget The next table comes from the FY 12 budget.

Table VI CPS enrollment projection FY 12 budget The actual enrollment in FY 11 was 7,319 students under the projected enrollment made in August of 2010. Moreover, in FY 11 CPS projected an increase in enrollment, but there was an actual decline of 5,890 students from FY 2010's enrollment or a decline of 1.44%. There is no explanation as to why CPS expects an increase in the number of 2012 in the budget, we wonder what this projection is based on?

Section VI: American Recovery and Reinvestment Act of 2009 (ARRA) Individuals with Disabilities Education Act (IDEA) Part B funds

As we have noted above CPS received lost its ARRA funding this year and Access Living feels that CPS completely mismanaged these funds and aggravated it current fiscal problems by doing so. In Access Living FY 2010 review of the CPS budget we noted that CPS allocated $57 million in ARRA special education funds as part of its FY 2010 budget. Of this $57 million, $49.5 million went to pay salaries of teachers working at special education schools under CPS Unit 19092. Two million was allocated to pay for special education teachers and aides in charter schools, and $5.5 million was planned to fund new and expanded special education programs at new and existing schools. What exactly these new programs were is still unclear.

CPS used its ARRA funds to legally supplant it own local special education funding efforts. The legislative intent of federal special education funds are to help ensure that students with disabilities have access to a free appropriate public education that meets each student’s unique needs and prepares each student for further education, employment, and independent living. The rules related to supplanting IDEA funds can be found at section 613(a)(2)(C) of that Act, which states that if, for any fiscal year, the allocation that school district receives under IDEA exceeds the amount that the school district received for the previous fiscal year, the district may reduce its maintenance of effort expenditures by up to 50% of that excess. CPS effectively avoided rules relating to these provisions by reducing its own revenue through not increasing property taxes it legally could have increased for FY 2010. The particular provision that CPS avoided is one that states if CPS students with disabilities are not academically achieving on our state’s standardized tests and not meeting other performance standards, then all of the ARRA dollars were required to be spent on educational improvement and reform for students with disabilities. CPS has never met this standard. If this rule were invoked, CPS could not have used at least $51.5 million of these dollars in the way it proposed in the FY 2010 budget. In the FY2010 budget, CPS allocated almost all ARRA IDEA Part B funds to pay for special education teachers’ salaries in special schools and in charter schools. On March 7, 2009 the US Department of Education (DOE) issued its principles relating to expenditure of these funds. The overall goals of the ARRA were to stimulate the economy in the short term and invest in education and other essential public services to ensure the long-term economic health of our nation. There are three essential principles established by the DOE in relation to these funds:

1. Spend funds quickly to save and create jobs.

2. Improve student achievement through school improvement and reform.

3. Invest one-time ARRA funds thoughtfully to minimize the "funding cliff."

The CPS allocation of its ARRA IDEA Part B funds in its proposed FY 2010 and FY 2011 budgets violated two out of three of these principles.

CPS made a decision not to levy property taxes which it had the power to do under the Illinois Property Tax Extension Limitation Law, commonly called “PTELL.”. As previously mentioned, in FY 2010 CPS made a decision not to raise property taxes to the allowable cap of 4.1% and instead chose to raise the rate to only 1.5%. In FY09, CPS elected not to raise property taxes at all. The millions of dollars lost by the failure of CPS to raise property taxes helped to create a situation where there is a fiscal necessity for using almost all of the ARRA IDEA Part B dollars to pay special education teacher salaries and benefits. CPS fundamentally created a situation of legal supplanting of these funds through its failure to raise funds. ARRA was not designed to be a property tax payers’ relief act.

The utilization of ARRA funds to pay the salaries of existing special education teachers did nothing to improve student achievement through school improvement and reform. An Access Living report released in April 2009, describes in detail the poor education and weak performance CPS and CPS Renaissance 2010 that many students with disabilities are currently experiencing. The ARRA funds which should be applied to these improvements are instead being spent on salaries for special educators because CPS has failed to raise money it could have raised through property taxes.

The CPS FY 2010 proposed budget explicitly stated on page 8: “CPS also expects a funding cliff within the next two years as its ARRA Title I Part A and ARRA IDEA Part B (federal stimulus) of more than $380M expires.” CPS was correct to expect a funding cliff because CPS is spending its ARRA IDEA Part B funds in violation of the principles established both by Congress and DOE. Special education teachers’ salaries are an ongoing obligation of the school district and using these funds to pay part of these salaries creates the funding cliff that the DOE asked not be created. The unfortunate reality was the DOE did nothing to prevent CPS and other districts from going off the cliff.

In the FY 2012 budget we can see the material reality of the funding cliff. In the segment report attached to that budget we can see that unit 19092 the special schools unit increased dramatically the dollars spent by the general fund for position for these schools going from a total of $24,050,664 in FY 11 to $40,931,382 in FY 12 after the ARRA funds had been exhausted. Moving towards a Universal Design for Learning model in CPS In this section we repeat what we stated in 2008 in our review of the FY 09 budget, it was true then and still is true. CPS had been on a hunt for ways to reduce costs related to educating students with disabilities. Fundamentally this effort has failed; costs have continued to rise, even as CPS has imposed various reductions in services, including the provision of one on one aides to some severely disable students. The greatest possibility for controlling ever increasing special education costs and improving academic results is by moving towards a Universal Design for Learning model in many elementary level classrooms over a period of years. There is much talk of “inclusion” and “differentiated instruction” in special education circles that does not focus on improved academic skills for students with disabilities. In this literature it is expected that a regular education teacher will be able differentiate instruction for students with disabilities without understanding the ramifications of these students’ disabilities on their learning process. The heart of the problem is the separation between special education and regular education teachers’ knowledge base. The solution is to be found in new types of classrooms in many schools with overall class sizes small enough where students with mild disabilities can effectively be instructed by one highly qualified cross trained teacher in primary and middle school grades. In addition to the cross certification these teachers need to have extensive training in the teaching of reading. These teachers because of the work load they would face must be paid beyond the level of teachers who are not cross trained with these extensive skills.

As of June 2008 in grades 1-12 there were about 14,000 students with learning disabilities who are receiving direct special education services for no more than 5 hours a week. That number has likely grown by 2011. These students were assigned to approximately 700 special education teachers’ case loads. These teachers constituted about 19% of all projected FY09 special teachers. The cost for these 700 teachers was at least $42 million based just on average salaries not including benefits. The special education teachers that primarily service these students are called “resource” teachers. Over the last ten years more and more of the actual service provision for these students is taking place within general education classrooms, with fewer group pull out classes. In elementary schools resource teachers are covering numerous classrooms during a school day, often only spending forty minutes or less in any one room. Many of these 14,000 students receive no direct special education services at all, instead their regular education teachers are provided consultative services by a resource teacher on often irregular time schedules. The resource model as it exists in elementary schools is highly problematic and is clearly not producing the type of results we need for these students. It does not provide comprehensive support for these students; instead it focuses completely on the areas of greatest academic deficits for a limited time each day. For example students may be pulled out for language arts because of significant deficits in reading skills, yet these same students may be included in regular education social studies with a grade level text book that a general education teacher is expected to modify for the student.

The consultative aspects of the resource model are even more problematic because these special education teachers do not have the time during a school day to observe students who are not receiving direct services and cannot provide truly relevant advice to general education teachers. Many regular education teachers in many CPS elementary schools feel abandoned by this consultative model.

If CPS assigned six mildly disabled students to a classroom of 20 students taught by one highly trained cross certified teacher in the primary and middle grades CPS could reduce one and a half resource positions for each five “real inclusion” classrooms created. Because a 20 student classroom is about five students smaller than the average size in grades 2-6 such a model would also require creating one new general education classroom for about each five of these real inclusion classrooms on a system wide basis. Because these cross certified teachers will need an incentive to take such challenging positions CPS will need to pay a premium to these teachers in addition to their base salaries inclusive of step and lane. We would suggest CPS should be paying at least a $6,000 per year premium to these teachers. The CPS could at a cost of less than $2 million per year establish 150 such classrooms and provide each classroom with $1,000 supplementary materials budget per year. The six students with disabilities in these classrooms need to be the same individual children all school day long, schools cannot rotate disabled students in and out of these real inclusion rooms. Students with disabilities in these real inclusion model classrooms would need to advance classes using the same model up to the junior high level or when they exit special education. This model would need to be evaluated over a period time to see if more students with disabilities were achieving State standards than were similar students using traditional separate regular and special education teachers, if more of these students were transitioning out of special education altogether, and if there were positive effects on the non-disabled students in these classrooms.

There is nothing in the State School Code that would clearly prohibit such a merger of regular education and special education teachers as long a required services indicated on IEPs are provided. But there are interpretations of the existing Code that may have to be addressed. The current ISBE special education teacher funding reimbursement scheme is modified for the CPS by Illinois state law at 105 ILCS 5/1D 1 and CPS could receive appropriate reimbursement for each of these cross certificated teachers.

The CPS would have to negotiate this issue with the Chicago Teachers Union (CTU) and push some charter schools in this direction via the special education reimbursement system. The Illinois Administrative Code at 226.735 requires that the CPS and the CTU “in cooperation” shall adopt a plan specifying limits on the workload of its special educators so that all services required under students’ IEPs are provided. These plans and negotiations were required to be completed by the start of the 2009-2010 school year, which has not yet been done. Beginning in the 2009-2010 school year a defined case load for what had been called “resource” teachers has been effectively abolished. Class sizes for separate classes containing only students with disabilities will remain, but for special education teachers working inside regular education classrooms no fixed ratio will exist. This can either be an opportunity or a disaster for students with mild disabilities. Access Living opposed this change in the Illinois Administrative Code at every level because there was no defined replacement for the current standards. Such a merged regular education and special education approach as we suggest will not work for students requiring special education services for more than 20% of the school day; it will likely not work at the high school level because of the complexity of the curriculum and larger class sizes. It will not work if CPS places more than six students with disabilities in classrooms or has class sizes larger than 20 students.

It will not work if these classrooms are over loaded intentionally with regular education students who are suspected of having disabilities, but have not yet either been identified or have entered an RtI type process. Because of space considerations it will not work in significantly over crowded elementary schools. Most importantly it will not work if CPS does not highly compensate teachers who take on this complex teaching assignment. Currently there are at least several hundred teachers in CPS who are cross certified already working either as special education teachers or regular education teachers, but formally not as both within the same classroom. The Board must take some type of steps to change this failed special education system. A system that costs much and produces limited results for far too many students. We have suggested one place to start this complex reform process. Recommendations relating to the CPS FY2012 budget

● We believe CPS should pass a rule limiting the time frame for RtI interventions for students suspected of having disabilities. We recommend that CPS adopt a policy limiting the length of interventions to no more than 12 weeks if the school cannot demonstrate the student is making academic progress and move to a full case study evaluation for these students to determine if they have a disability as defined by federal and state law. Since CPS wants to cut funding in relation to RtI implementation it should seek to change existing state regulation which make this process mandatory. We would be glad to support CPS in this effort in Springfield. ● We applauded the fact that CPS has authorized the creation of a Board of Education Finance and Audit Committee a year ago. But the rule that created this committee, 10-0728-RU1, did not give it a clear role in the budget process. We strongly recommend that CPS look at the ISBE Board's budget process and its use of a subcommittee in that process. ● We think CPS should be aggressively lobbying the Chicago City Council to retrieve excess funds currently in TIF accounts. CPS should be requesting fiscal impact studies on any new TIF districts that are proposed in the future and act in the best interests of CPS in relation to tax dollars lost from such proposed TIF districts. ● We agree with much of what was written in the proposed budget on new fiscal accountability measures, especially to: "Shine sunlight on the budget so all can see what we are doing" (Budget page 10). But the FY12 proposed budget does not yet shed much sunlight in many areas.