Should teacher pension money support anti-union University of Chicago charter schools?... Chicago Teachers Pension Fund Questions Management Firm’s Charter Ties

The Chicago Teacher’s Pension Fund (CTPF) wants to hire the best money managers to make the Fund money so that teachers can retire with a nice pension. But what if the head of one of those investment firms they hired also sits on the Board of Directors of a notoriously anti-union charter school — created as part of Mayor Daley's Renaissance 2010 Plan — which is destroying the Chicago Teachers Union and other unions by replacing unionized schools with non-union charter or contract schools?

A tattered American flag flew over the University of Chicago charter school "Donoghue Campus" in November 2006 as the anti-union charter schools sponsored by America's foremost "free market" university began its privileged expansion across the South Side. The Donoghue Elementary School building, which once provided a public school education to thousands of children from the nearby Ida B. Wells public housing project, became part of the overall plan for the gentrification of the area around 39th and Cottage Grove Ave. The University of Chicago charter schools promise their teachers higher starting pay than nearby public schools, but then squeeze those teachers out when they become veterans. Substance photo by George N. Schmidt.Thanks to the election of at least two new trustees to the Chicago Teachers Pension Fund (CTPF) last October, that question has now been brought to the center of the debate about how Chicago's teacher pension fund invests the nearly $10 billion it is managing on behalf of Chicago teachers.

A tattered American flag flew over the University of Chicago charter school "Donoghue Campus" in November 2006 as the anti-union charter schools sponsored by America's foremost "free market" university began its privileged expansion across the South Side. The Donoghue Elementary School building, which once provided a public school education to thousands of children from the nearby Ida B. Wells public housing project, became part of the overall plan for the gentrification of the area around 39th and Cottage Grove Ave. The University of Chicago charter schools promise their teachers higher starting pay than nearby public schools, but then squeeze those teachers out when they become veterans. Substance photo by George N. Schmidt.Thanks to the election of at least two new trustees to the Chicago Teachers Pension Fund (CTPF) last October, that question has now been brought to the center of the debate about how Chicago's teacher pension fund invests the nearly $10 billion it is managing on behalf of Chicago teachers.

Teacher Trustee Jay Rehak, said the issue is one that needs to be addressed by the Board of Trustees.

This question dominated the latest CTPF Investment Committee meeting on Thursday, February 11, 2010, at the Fund’s headquarters at 203 N. La Salle Ave. Andre Rice, the director of Muller and Monroe, which is managing some of the teachers’ pension money, also sits on the Board of Directors of the University of Chicago Charter Schools.

The University of Chicago charter schools, which have received several buildings from the Chicago Board of Education since their expansion began eight years ago, are all non-union schools at this time. At the beginning of the 2009 - 2010 school year, the University of Chicago charter schools operated four elementary schools and one high school, all located in buildings that once housed regular Chicago public schools.

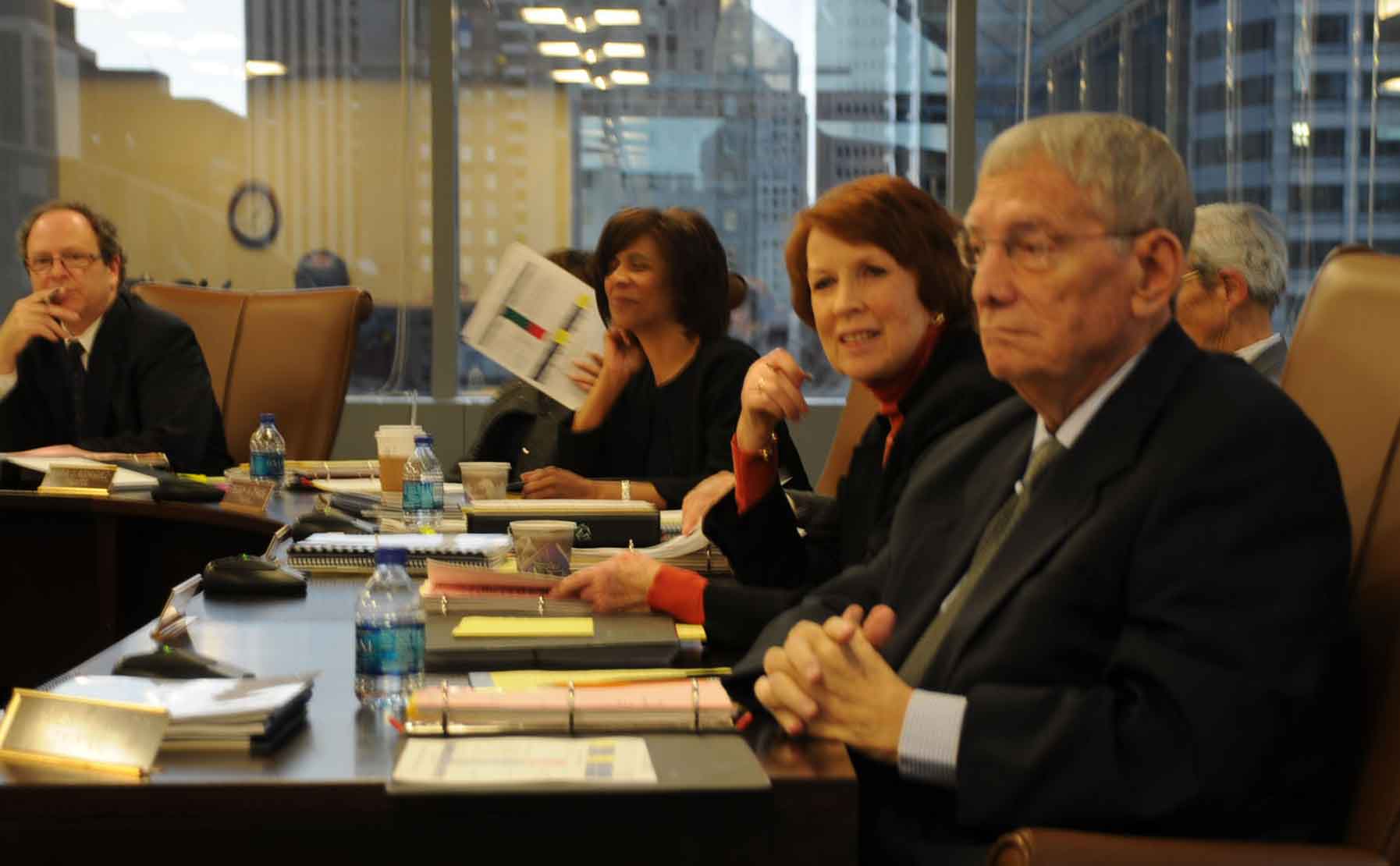

Critical questions regarding the relationship between one of the investment firms currently working for the Chicago Teachers Pension Fund (CTPF) came from trustees Mary Sharon Reilly (second from right) and James Ward (right) during the February 11 meeting of the Fund's investment committee. Ward and Reilly are depicted above from the Fund's November meeting. Substance photo by George N. Schmidt.All of the University of Chicago charter schools are located on the city's South Side, within two miles of the university's main campus. “Are they supporting something that in the long run will hurt teachers?” Trustee Mary Sharon Reilly wanted to know. The question to ask, CTPF Director Kevin Huber told the trustees, is whether the head of this private equity firm is putting his own money or his firm’s money into the charter school. Rice did not attend the meeting because of a snow storm in New York. His partner told trustees he did not know if Rice was directing any resources from the firm into the charter schools.

Critical questions regarding the relationship between one of the investment firms currently working for the Chicago Teachers Pension Fund (CTPF) came from trustees Mary Sharon Reilly (second from right) and James Ward (right) during the February 11 meeting of the Fund's investment committee. Ward and Reilly are depicted above from the Fund's November meeting. Substance photo by George N. Schmidt.All of the University of Chicago charter schools are located on the city's South Side, within two miles of the university's main campus. “Are they supporting something that in the long run will hurt teachers?” Trustee Mary Sharon Reilly wanted to know. The question to ask, CTPF Director Kevin Huber told the trustees, is whether the head of this private equity firm is putting his own money or his firm’s money into the charter school. Rice did not attend the meeting because of a snow storm in New York. His partner told trustees he did not know if Rice was directing any resources from the firm into the charter schools.

Charter schools are seen by many as an anti-union venture where children from better off families remove their children from surrounding public schools, thus leading to many public school closings. In Chicago, the majority of charter school teachers are non-union, and growing documentation is demonstrating that anti-union activities are part of many charter schools' employment policies.

Charter school teachers generally earn less and work longer hours than public school teachers and do not have basic contract rights stipulated in a collective agreement.

In Chicago, charter school teachers are not allowed to join the Chicago Teachers Union because of the terms of the Amendatory Act of 1995 (the same law that gave Mayor Richard M. Daley control over the city's public schools). As a result, charter school teachers who want to be unionized have to form their own small union locals and bargain from a smaller base of organized members than CTU members have.

A major discussion of the relationship of the Fund's investment contractors and anti-union charter schools began when trustee Jay Rehak (above, center, at the November 2009 meeting of the trustees) questioned why the Fund had money with a firm headed by a man who sat on the Board of Directors of the anti-union University of Chicago charter schools. Above, left to right, Alberto Carrero (Board of Education trustee), Lois Ashford (teacher trustee), Jay Rehak (teacher trustee), Linda Goff (teacher trustee), and Lois Nelson (teacher trustee). Substance photo by George N. Schmidt.However, charter school teachers do pay into the Chicago Teacher’s Pension Fund. While regular public school teachers kick in 2% and Chicago Public Schools another 7% for a total of 9% of salary paid into the teachers’ pension fund, charter school teachers also pay 9% of their salary into the pension fund. But it depends on each charter school how much the teacher must pay into the fund.

A major discussion of the relationship of the Fund's investment contractors and anti-union charter schools began when trustee Jay Rehak (above, center, at the November 2009 meeting of the trustees) questioned why the Fund had money with a firm headed by a man who sat on the Board of Directors of the anti-union University of Chicago charter schools. Above, left to right, Alberto Carrero (Board of Education trustee), Lois Ashford (teacher trustee), Jay Rehak (teacher trustee), Linda Goff (teacher trustee), and Lois Nelson (teacher trustee). Substance photo by George N. Schmidt.However, charter school teachers do pay into the Chicago Teacher’s Pension Fund. While regular public school teachers kick in 2% and Chicago Public Schools another 7% for a total of 9% of salary paid into the teachers’ pension fund, charter school teachers also pay 9% of their salary into the pension fund. But it depends on each charter school how much the teacher must pay into the fund.

If a charter school teacher is not certified they do not pay into the pension fund, CTPF attorney Joseph Burns said. A law that opened up the cap for more charter schools in Illinois now mandates that 75% of teachers in charter schools be certified.

In addition to charter schools, Chicago has "contract" and "performance" schools which have been set up during the years of "Renaissance 2010" (Mayor Daley's plan to create "new schools" for Chicago). Contract school teachers also do not pay into the Chicago Teachers Pension Fund. The Chicago Teachers Union is currently supporting a contract school in which the teachers have no pension plan, only a 401K.

The Pension Board decided that any future private equity firm looking to manage Chicago Pension Fund money must disclose if they have ties to a charter school. There are other current money managers, including Northern Trust Bank, which is currently being sued by the CTPF for risky investments, who have ties to charter schools, Huber said.

“You may not like their politics, but they have a fiduciary responsibility,” Huber told the Board. “How much time are they putting into the charter school and how much time have they put into our fund.”

Apparently not enough, according to Jay Rehak, a recently elected trustee to the pension board who noted that Muller and Monroe’s current $35 million investment is losing money after five years. “In light of the fact that Muller and Monroe has lost the Pension Fund 17% of its investment on an annualized basis, perhaps Mr. Rice has been too busy working on the Board of Directors of the University of Chicago Charter School and he has lost sight of making the Pension Board money.”

Irwin Loud, the chief investment officer for Muller and Monroe, said the reason their firm is losing money for Chicago teachers now is because they have not invested all the money.

“We won’t be positive until all the money has been invested,” Loud told the trustees. “Our managers are building you an orchard.”

Rehak then quickly countered, “Orchards usually produce in five years, so I’m still waiting.”

The trustees then asked Loud about his director’s ties to the University of Chicago charter schools.

Rehak also asked the Pension Board staff to determine how much of an effect charter schools have on the pension fund. For example, high turnover at charter schools means teachers pay less into the fund than veteran teachers earning higher salaries. But the fund would pay out less because these teachers would not retire with a pension. The pension fund will lose money when there are less teachers paying into the fund, CTPF attorney Burns said. But it is to the Fund’s advantage when there are more young teachers who are not vested and leave the system, he added.

“Are we taking a hit by this privatization?” Rehak asked.

The Pension Board’s attorney said they can do a number crunch to see what the overall effect charter schools have on the teacher’s pension fund.

Following the discussion on charter schools, Muller and Monroe made a short presentation to the Board.

The private equity firm first started investing Chicago teachers’ money in 2004.

Loud said Rice is very passionate about education and helping “underprivileged kids.” He said he would ask how Rice is funding the charter schools.

A couple of teacher trustees noted the irony of Rice’s desire to help children, stating that they are equally concerned about education, including the displacement of public school children and teachers due to the proliferation of charter schools. By meeting’s end, a proposal was approved to include language in all future Request for Proposals (RFP’s) that all money managers list their associations with Board of Directors of Charter Schools. In this way, the Board can determine if money managers are more interested in outside activities or making the Pension Fund money. Specific language of the RFP’s are to be approved at a subsequent Pension Board meeting.

Final version of this article posted at www.substancenews.net at 3:00 a.m. on February 18, 2010. EDITOR'S NOTE ON REPUBLICATION USE. This is copyrighted content, news and analysis prepared and published by the staff and supporters of Substance (the print monthly) and Substance News Service (www.substancenews.net). Both are publications of Substance, Inc. Chicago, Illinois. The final edited version of this article and the accompanying graphics were posted at www.substance news.net February 18, 2010, 3:00 a.m. CDT. If you choose to reproduce this article in whole or in part, or any of the graphical material included with it, please give full credit to SubstanceNews as follows: Copyright © 2010 Substance, Inc., www.substancenews.net. Please provide Substance with a copy of any reproductions of this material and we will let you know our terms. Alternatively, please make a donation or take out a subscription to the print edition of Substance (see red button to the right). We are asking all of our readers to either subscribe to the print edition of Substance (a bargain at $16 per year) or make a donation. Both options are available on the right side of our Home Page. For further information, feel free to call us at our office at 773-725-7502. Collegial groups and teachers using this material for class use should simply inform us of the extent of your usage. Anyone utilizing this material for commercial purposes is in violation of U.S. and other international copyright laws. Copyright 2010 Substance, Inc. all rights reserved.

Comments:

By: Ren10 Apartheid- time to divest!

Thank you Jay--about time!

How many CTU members attend Bulls Games? yet, they set up a charter to please Ceasar Daley and this hurts ALL union members. CPS sends teachers emails to get us to attend Bulls games! There is more quid pro quo. Great job Jay! It is time to call out this REN 10 Apartheid!

By: Danny

Charter ties?

Waitaminnit.

Charter school teachers in the City of Chicago pay into the CTPF just like CPS teachers. So, like it or not, there are "charter ties" to the Pension Fund.

CTPF and the Chicago Teachers Union are entirely separate entities. Remember, all Chicago teachers pay into the Pension Fund, but not all Chicago teachers are CTU members.

As for me, I like the lead sentence of this story.

By: Jesse Sharkey

Unions Protect Our Pensions

In the first instance the very existence of pensions goes back to groups of workers organizing to ensure their ability to retire. Whether it was labor as part of the New Deal coalition, union's role in passing ERISA, etc. the health of our pensions has never simply been about 'choosing good fund managers' but has always been about labor's power to make sure that our pensions are adequately funded and protected by law.

In today's political climate, where attacks on pensions are the order of the day, and where organized labor is one of the few forces trying to defend pensions, we shouldn't be short-sighted: if the people who are managing our pension money are enemies of our union, ultimately this will undermine us.

Even some of our union 'leadership' needs to learn this lesson. Dennis Gannon, President of the Chicago Federation of Labor, recently called for the privatization on Midway Airport, with the proceeds to be used to fund municipal pensions. How short-sighted. First, Daley will not use the loot he makes from privatization to save our pensions; he hasn't done it yet, why should he start now? Second, moving jobs from the public sector (35% union, non-profit, regulated) to the private sector (7% union, for-profit, sketchy oversight) is a recipe for our destruction, not for saving our pensions.

By: Jim Vail

Charter Ties?

Usually I like what Danny posts.

This time it's a little bit funny.

He likes my first sentence that the key to the CTPF is hiring the best money managers to make money for teachers' pensions.

But the devil is in the details - it's a shame he doesn't look at another important sentence further down in the story.

It states that fewer teachers who pay into the fund hurts the CTPF.

Not all teachers pay into the fund. That includes charter teachers who are not certified (yes there are many out there) and contract school teachers who both replace CTU teachers when they close more public schools.

That means the number of teachers paying into the CTPF fund goes down - not good Danny.

Kind of reminds me of the old saying: 'The capitalist will sell you the rope to hang himself with.'

In this case, does Danny see any problem with less teachers paying into the Pension Fund?

But hey, at least our money managers are makin money for us - though it looks like a golden rope they're selling.

By: Lois Ashford

Management Firm's charter Ties

Dear Substance:

I was a displaced teacher that was recently elected as a pension fund trustee.

As such, I too am concerned that Muller & Monroe's primary interests may be elsewhere. As I stated, How is Mr. Rice going to "help" the very students he is disenfranchising by closing and taking over their neighborhood school? And then, to add insult to injury he wants to invest the pensions of the very teachers he is helping to force out of work?

This is a clear case of being paid from all sides. The CORE members of the pension fund will do everything possible to ensure a level playing field as it relates to the pension of our members.

I will continue along with Jay Rehak to monitor the fund closely so as to ensure that the only monies some of our pensioners have left is invested safely.

Lois Ashford

Pension Fund Trustee

By: kugler

Good Work

it is obvious now that jay was the right person for the job! keep up the pressure on these crooks! nice report jim. imagine some upc hacks nodding their heads and rubber stamping anything across the desk waiting for the next cocktail party.

this is why there has to be a multi-party union administration so this corruption stops. one party control only breeds apathy and malfeasance. no matter what opposition party wins they need to bring in a coalition of leadership to fight the stealing of public funds that has gone on too long.

john kugler