‘Tax the rich’ is the message as a coalition of unions and community activists protests at State of Illinois Building in Chicago, while lawmakers meet to pass emergency spending plan in Springfield...

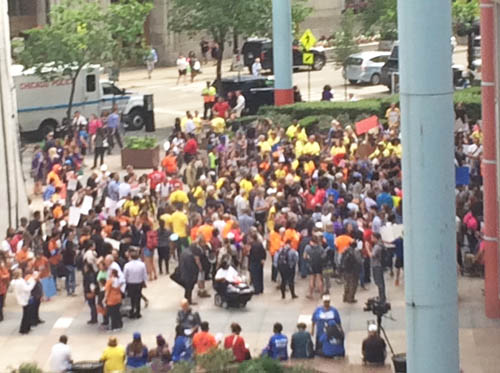

About 2,000 protesters gathered outside the James R. Thompson State of Illinois Building on Thursday, June, 30, 2016, as the Illinois state government began a second year without a budget. Schools and state funded services have lost funding. Causes of the budget crisis include a drop in the state income tax rate at the end of the previous governor’s term in office, and the present governor’s continuing refusal to sign any budget unless the legislature grants his wish for anti-union legislation. The protesters offered a simple solution to restore the funding: “Tax the rich!” Substance photo by David R. Stone

About 2,000 protesters gathered outside the James R. Thompson State of Illinois Building on Thursday, June, 30, 2016, as the Illinois state government began a second year without a budget. Schools and state funded services have lost funding. Causes of the budget crisis include a drop in the state income tax rate at the end of the previous governor’s term in office, and the present governor’s continuing refusal to sign any budget unless the legislature grants his wish for anti-union legislation. The protesters offered a simple solution to restore the funding: “Tax the rich!” Substance photo by David R. Stone

Emergency state budget negotiations prompted an emergency rally. Illinois lawmakers were meeting in Springfield to pass a temporary spending plan on Thursday, June 30, 2016 (as the state earned a dubious distinction as the only state in the nation to go for a full year without a budget to allocate spending on government services) –- so a coalition of activists from community organizations and unions called for an emergency rally at the James R. Thompson State of Illinois Building in downtown Chicago.

Although the rally was announced less than two days in advance, it drew a crowd estimated by this reporter to number about 2,000 people. Actions were scheduled earlier in the day at various sites owned by corporations or individuals who are benefitting from tax breaks. The protesters then gathered in the plaza between the State of Illinois Building and City Hall, at the corner of Washington and State Streets. The crowd demanded that wealthy citizens and corporations pay their fair share of taxes, to restore all the services that have been cut due to lack of government funding. With signs, chants, and speakers, an overall message of “tax the rich” was stated in many ways by representatives of many groups that rely on state funding.

For example, one sign stated, “@McDonaldsCorp costs the state $368M in subsidies, which could be used for the housing of 22,030 homeless youth.” Another sign declared, “Gov. Rauner got $767K tax cut in 2015… We could have funded MapGrants for 275 students.”

Alongside teachers, parents and students from pre-schools, elementary schools, high schools, colleges and universities were advocates for the disabled, homeless, elderly, neighborhood organizations, and immigrants.

Protesters marching from the State of Illinois Building to Chicago City Hall on Thursday, June 30, 2016, pointed to bankers as one source of the budget woes that are forcing cuts in funding for schools and social services. Referring to “interest rate swaps” such as those that made the Chicago Board of Education pay extra for money loaned by Chase Bank, the banner at the front of the march said, “CHASE: Stop swapping people’s services for your profits!” Substance photo by David R. Stone

Protesters marching from the State of Illinois Building to Chicago City Hall on Thursday, June 30, 2016, pointed to bankers as one source of the budget woes that are forcing cuts in funding for schools and social services. Referring to “interest rate swaps” such as those that made the Chicago Board of Education pay extra for money loaned by Chase Bank, the banner at the front of the march said, “CHASE: Stop swapping people’s services for your profits!” Substance photo by David R. Stone

As the protesters finished listening to speakers and prepared to march across the street to City Hall, news came from Springfield that the legislature was passing a spending plan that would cover the next six months, not a real budget for the coming year, and with no new taxes nor other new sources of revenue. The protesters were not satisfied, and proceeded with the march, shouting such chants as “Banks got bailed out; we got sold out!” and “Our communities are under attack. What do we do? Stand up! Fight back!”

Comments:

By: Rod Estvan

Complexity of property taxes

David Stone was correct to point out that property taxes were increased within the City to support the Chicago Teachers Pension Fund. He is not totally correct when he writes: "property taxes have the potential to collect income from wealthy corporations and individuals." It is true that as a general rule more wealthy individuals own higher valued homes, but it is much more complex for what is called non-residential property.

Illinois state statute requires that all real property be valued for the purpose of property taxation at 33 1/3% of its fair cash value in every county except Cook. Cook County is the only county in the State of Illinois that sets different property tax assessment levels for different types of property. This differential assessment is called classification and is expressly permitted for counties with a population greater than 200,000 by the Illinois Constitution Article IX Section 4. The state constitution also requires that the level of assessment or rate of tax for the highest class of property be no more than 2.5 times the level of assessment or rate of tax for the lowest class of property.

There are also “incentive” classes, which provide reduced assessment levels for certain periods of time to encourage specific use or redevelopment. These are sort of like TIFs using property tax values, in fact in a few cases incentive classes have been created within TIF districts. But these low rate classes because of the Constitution have a limiting impact on how high the tax rate can be on certain types of commercial, industrial, and apartment properties. Generally no incentive class has been created that allows for property to be valued at less than 16% of its fair cash value.

Property taxes are reasonably considered regressive taxes because property tax is based on the value of your property. It is the same regardless of your income. If your income goes down, the tax becomes a bigger percentage of your income. But in the situation of CPS and the CTPF there were no other options available for more progressive taxation that couldn't pass the Illinois General Assembly which is heavily influenced by corporate interests and where both the Speaker of the House and the President of the Senate are property tax attorneys.

Rod Estvan

By: David R, Stone

Revenue update

My article states that as the last of the activist speakers were addressing Thursday's budget rally, the legislature's six-month spending plan was announced. At the time, the crowd was not informed of any new taxes nor new revenue sources for state-funded services. In fact, however, the budget deal in Springfield includes a property tax levy to help fund teacher pensions.

This is a good and important step in the rigjht direction, and property taxes have the potential to collect income from wealthy corporations and individuals. However, the Illinois budget crisis is not over, and the protesters' demand to end many specific tax breaks for the rich was not met. Even if full details of the budget deal had been known at the time, I am sure the crowd would have been unsatisfied, and would have continued to march on City Hall.

-David R. Stone

drstone@ameritech.net