Illinois politicians and corporate media get an 'F' on the Constitution test... Judge's pension ruling is not complicated at all... Why is Illinois Attorney General Lisa Madigan appealing the verdict on SB1 and corporate 'pension reform'?

Illinois Federation of Teachers President Dan Montgomery (right) led the "We Are One" effort to oppose the governor's pension attack in court. Above, Montgomery sat with Chicago Teachers Union Vice President Jesse Sharkey and others at the union's LEAD dinner on October 31, 2014. Substance photo by Sharon Schmidt.Although most public school students are still required to study and pass a test on the Illinois and U.S. constitutions, apparently some of the state's top politicians, including the state's chief law enforcement officer, should get an "F" on the Illinois Constitution test. The reality is that there was no legal basis for claiming, as lame duck Governor Pat Quinn and a majority in the legislature tried to do, that "pension reform" could ignore the Illinois Constitution.

Illinois Federation of Teachers President Dan Montgomery (right) led the "We Are One" effort to oppose the governor's pension attack in court. Above, Montgomery sat with Chicago Teachers Union Vice President Jesse Sharkey and others at the union's LEAD dinner on October 31, 2014. Substance photo by Sharon Schmidt.Although most public school students are still required to study and pass a test on the Illinois and U.S. constitutions, apparently some of the state's top politicians, including the state's chief law enforcement officer, should get an "F" on the Illinois Constitution test. The reality is that there was no legal basis for claiming, as lame duck Governor Pat Quinn and a majority in the legislature tried to do, that "pension reform" could ignore the Illinois Constitution.

And so, on November 21, 2014, a Sangamon County Appellate Judge issued a brief decision upholding the Illinois Constitution insofar as it requires that public worker pensions be honored.

The complete decision can be found at: http://www.weareoneillinois.org/documents/SangamonCounty.pdf

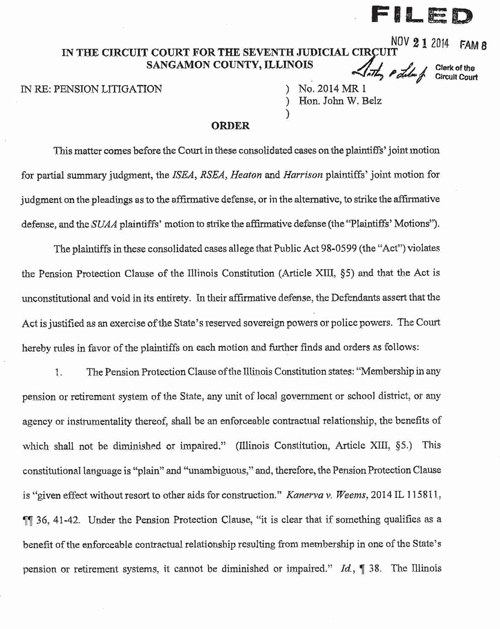

Judge Belz's ruling runs fewer than six pages because the issues under the Illinois Constitution are so clear. Above, the first page of the Judge's ruling.The Judge's decision was perfectly clear and consistent with the Illinois Constitution. Sangamon County Circuit Court Judge John Belz agreed with those who had sued challenging the December 2013 law. Judge John Belz said that it �without question� violates the state constitution�s provision that a public worker pension cannot be �diminished or impaired.� The state of Illinois made a constitutionally protected promise to its employees concerning their pension benefits,� Belz wrote. �Under established and uncontroverted Illinois law, the state of Illinois cannot break this promise.�

Judge Belz's ruling runs fewer than six pages because the issues under the Illinois Constitution are so clear. Above, the first page of the Judge's ruling.The Judge's decision was perfectly clear and consistent with the Illinois Constitution. Sangamon County Circuit Court Judge John Belz agreed with those who had sued challenging the December 2013 law. Judge John Belz said that it �without question� violates the state constitution�s provision that a public worker pension cannot be �diminished or impaired.� The state of Illinois made a constitutionally protected promise to its employees concerning their pension benefits,� Belz wrote. �Under established and uncontroverted Illinois law, the state of Illinois cannot break this promise.�

One of the most interesting things about the decision was that the news reporting was generally lacking in even the most basic facts about the Illinois constitution, Illinois law, and public worker pension problems.

Most of the stories (see below) ignore the fact that the "unfunded liability" of the pensions (note: it is not a debt, because it is based on the situation that would take place if all public workers were to apply for their pensions today) in Illinois was caused not by the pensioners or those on active duty and paying into the pension plans -- but because the politicians didn't pay their fair share over decades. And so today the claim is made that those who did pay their fair share [disclosure: this reporter is a Chicago Teachers Pension Fund pensioner] should suffer because other people basically robbed us.

The Illinois Federation of Teachers organized the We Are One coalition that brought the lawsuit. In a statement on November 2, 2014, the IFT said:

PENSION VICTORY!

11/21/2014

Moments ago, a Sangamon County Circuit Court judge granted motions brought by the We Are One Illinois union coalition and the other plaintiffs, ruling that the pension clause of the Illinois Constitution is absolute in its protection of public pensions and that legislation (SB1) reducing the pensions of active and retired teachers, state employees and university employees is "unconstitutional and void in its entirety"!

IFT President Dan Montgomery noted that this decision brings long-awaited justice to IFT members and all public employees.

�It is a great day for working families in Illinois, and the IFT is proud to have played a key role in this outcome as part of the We Are One Illinois coalition. Today the court affirmed what the coalition has contended all along - that the state Constitution expressly prohibits our benefits from being diminished. Now, it�s time to focus our energy on working once again with those lawmakers and leaders who are willing to develop a legal and fair solution to our state�s challenges, together.�

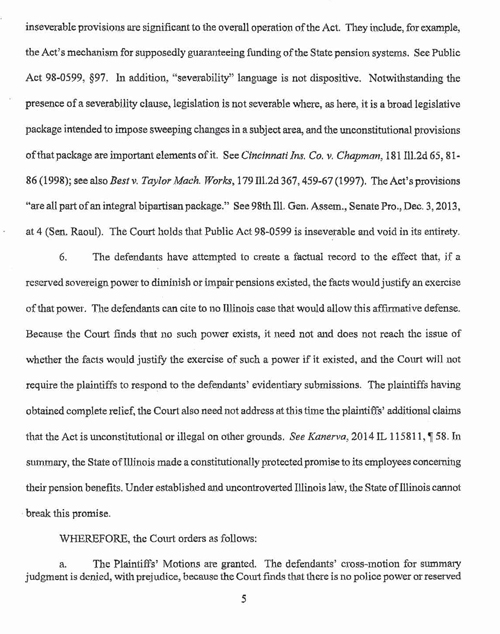

The final paragraphs of Judge Belz's decision and the court order are on the fifth and sixth pages of the decision.The IFT is a strong partner in the We Are One Illinois labor coalition, which released this statement immediately following today's favorable ruling:

The final paragraphs of Judge Belz's decision and the court order are on the fifth and sixth pages of the decision.The IFT is a strong partner in the We Are One Illinois labor coalition, which released this statement immediately following today's favorable ruling:

�We are gratified by the court�s ruling today, which makes clear that the Illinois Constitution means what it says. The court held today, as our unions have long argued, that the state cannot simply choose to violate the Constitution and diminish or impair retirement benefits if politicians find these commitments inconvenient to keep.

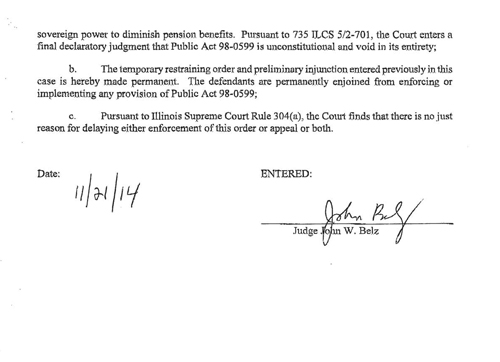

The final declaratory judgment that "Public Act 98-0599 is unconstitutional and void in its entirely."�This is a victory for every Illinois resident who believes in the integrity of the Constitution. It is a victory for a basic principle of fairness, that working people and retirees who earned modest pensions and always paid their share should not be punished for politicians� failures. And it is a victory for the members of our unions, who work hard every day in every Illinois community to teach kids, protect public safety, care for the most vulnerable and much more, today they are more secure in the knowledge that their life savings can�t be taken away from them.

The final declaratory judgment that "Public Act 98-0599 is unconstitutional and void in its entirely."�This is a victory for every Illinois resident who believes in the integrity of the Constitution. It is a victory for a basic principle of fairness, that working people and retirees who earned modest pensions and always paid their share should not be punished for politicians� failures. And it is a victory for the members of our unions, who work hard every day in every Illinois community to teach kids, protect public safety, care for the most vulnerable and much more, today they are more secure in the knowledge that their life savings can�t be taken away from them.

�Going forward, our union coalition repeats our longstanding commitment to work with anyone of good faith to develop a fair and constitutional solution to fund the state�s retirement systems.�

View the judge's ruling here.

The state announced its plans to appeal to the Illinois Supreme Court. Stay tuned for more information as it becomes available.

There is little doubt in the mind of informed observers that Illinois is wasting more taxpayer money by allowing Lisa Madigan to take the case to the Illinois Supreme Court. Media reports make interesting reading. Below are a few...

TRIBUNE REPORT BELOW HERE:

A Sangalmon County judge on Friday [November 21, 2014] struck down the state�s landmark pension law that sought to fix Illinois� $104.6 billion government retirement system debt, declaring the measure unconstitutional and clearing a path for a showdown in the Illinois Supreme Court.

Sangamon County Circuit Court Judge John Belz agreed with public employee unions and retirees who challenged the December 2013 law, maintaining that it �without question� violates the state constitution�s provision that a public worker pension cannot be �diminished or impaired.�

Bruce Rauner says he hopes Illinois Supreme Court gives clue on pension law

Bruce Rauner says he hopes Illinois Supreme Court gives clue on pension law

Monique Garcia and Ray Long

�The state of Illinois made a constitutionally protected promise to its employees concerning their pension benefits,� Belz wrote. �Under established and uncontroverted Illinois law, the state of Illinois cannot break this promise.�

While the ruling drew praise from unions and retirees, state officials worry it could undermine state finances that already are precarious. A re-election seeking Mayor Rahm Emnanuel also is watching closely to see what ramifications the court battle has for the city, which faces a $550 million increase for police and fire pension funding in 2016 unless the General Assembly grants some relief.

Illinois Attorney General Lisa Madigan said she will appeal the decision to the state�s high court, where cases go when a state law is declared unconstitutional. She will ask justices to expedite the appeal to get a resolution to the long-festering pension issue, �given the significant impact that a final decision in this case will have on the state�s financial condition.�

The judge�s ruling came after Democratic Gov. Pat Quinn and lawmakers approved pension legislation nearly a year ago that would scale back cost-of-living adjustments and require government employees to work longer before retirement but pay a little less toward their pensions. The idea was to cut the overall costs of paying down the pension debt and put the state on a 30-year road toward eliminating a massive hole created by decades of underfunding by prior governors and lawmakers. The unions sued.

The attorney general�s office argued that modifications in pension plans could be made in extraordinary circumstances, such as the overwhelming costs of the huge pension debt, but Belz brushed that aside Friday.

How many people have said, 'Let's see what the court gives us, what advice?' The language in the constitution couldn't be clearer.

- Dan Montgomery, Illinois Federation of Teachers

�The pension protection clause contains no exceptions, restrictions or limitations for an exercise of the state's police powers or sovereign powers,� Belz wrote, referring to positions Madigan�s office took in support the law.

Dan Montgomery, head of the Illinois Federation of Teachers, which includes the Chicago Teachers Union, called Belz ruling �a clear and total victory.�

A spokesman for Democratic House Speaker Michael Madigan noted that the ruling is just the first step in the legal process and maintained the law will be upheld by the Illinois Supreme Court.

cComments

Of course, if Illinois continues on the path to fiscal insolvency, taxpayers will move out to neighboring states like Indiana with better management and leadership. Unfortunately, if they take their penchant for voting for political scoundrels with them, then those states will start to fail...

ORPHANELLIE

AT 10:09 AM NOVEMBER 23, 2014

ADD A COMMENTSEE ALL COMMENTS 288

Democratic Senate President John Cullerton, who expressed doubts about the law�s constitutionality when it passed, said Friday the ruling �confirms that, while the need for reform is urgent, the rule of law is absolute.� Cullerton, who originally had championed a separate plan that involved trade-offs worked out with a union coalition, issued a statement that he �long believed there is a constitutional way to confront Illinois� pension challenges� and remained committed to that.

Senate Republican leader Christine Radogno said she remained �hopeful� state Supreme Court justices would find the law constitutional and, at the very least, provide guidance for potential changes.

Her comments reflected the view of Republican Gov.-elect Bruce Rauner, who said Friday before Belz ruled that he hoped the lower court�s decision would provide feedback on �what�s do-able and what�s not that we can begin to factor in.. . . It�s going to be a lot of work and we need to do a lot of planning.�

After Burge kept pension, Illinois House votes to curb funds for crooks

After Burge kept pension, Illinois House votes to curb funds for crooks

Ray Long

Quinn, who signed the much-hyped pension bill into law, once maintained he was �put on earth� to fix the state�s retirement systems and made a pension overhaul a top priority of his administration. A Quinn budget spokesman said Friday�s ruling would not have an immediate impact on the state budget because officials did not factor in pension changes to the current spending plan.

But if the high court upholds Friday�s ruling, the state's pension payment could jump from $6.2 billion this year to $6.9 billion in the next budget year. If the pension changes were upheld, that payment would be closer to $5.9 billion, according to the Quinn budget office.

In addition to state government, the Emanuel administration has a lot riding on the state Supreme Court�s ultimate ruling. In April, Emanuel got passed a state law that altered pensions for city of Chicago workers and laborers. Unions have been mulling a lawsuit.

The city legislation requires workers to pay more toward their retirements and reduces future increases to cost-of-living benefits. In exchange, the city is ramping up its payments into those funds until the increase hits $250 million a year in 2020.

Emanuel has maintained that his pension approach is different from the one enacted by the state because a majority of the city unions signed off on the plan. A top official with the Service Employees Union International Local 73 even urged Quinn to sign the bill.

Beyond that, Emanuel has said negotiations with police and fire unions to work out pension changes have stalled as the labor groups wait for the ruling on the state pension law. The outcome of those talks will have an even bigger impact on the city�s shaky finances.

Tribune reporters Monique Garcia, Michelle Manchir and Rick Pearson contributed.

BLOOMBERG NEWS COVERAGE BELOW HERE:

RECOMMENDED READING

Beckham Jr.�s Catch Lauded as Greatest Ever by Athletes

PLAY LIVE TV

ON LIVE TV NOW

Market Makers

HEADLINES PopularLatestRecommended

Based on your reading history you may like

Beckham Jr.�s Catch Lauded as Greatest Ever by Athletes

Hagel to Step Down as Defense Secretary, White House Aide Says

World�s Oldest Spice Bears Vietnam Modern Riches

Jets Are Out, Televisions In as Benefits of U.S. Growth Spread

Behind 700% Loans, Profits Flow Through Red Rock to Wall Street

Steve Cohen Can�t Shake SAC�s Crimes in Divorce Lawsuit

Get the Global Tech Today Newsletter.

Learn more

SIGN UP >

In Court Fight Over Dog Food, Poultry Byproduct Is the Smoking Gun

The Secrets of Surviving the 10 Grisliest Airports

Boeing's 777 Problem: Delta and Everyone Else Want Newer Planes

Click Here to See If You�re Under Surveillance

America Needs an Exit Tax

RECOMMENDED VIDEOS

AeroFarms Grows Plants Without Soil For Cities of the Future

Why Do Obama�s Executive Orders Differ From Others?

Alibaba Sells $8B of Bonds in Debut Sale

Audi's New Luxury Coupe Concept Is Our Future: Keogh

Obama�s Immigration Plan the Next Obamacare: Wadhwa

House Speaker Boehner: Immigration Action Is Damaging

BY TABOOLA

Advertisements

WATCH

President Obama Announces Chuck Hagel's Resignation

Tweet TWEET

Illinois Law to Fix $111 Billion Pension Deficit, Worst in U.S., Is Struck Down

By Andrew Harris, Tim Jones and Steven Church Nov 21, 2014 11:01 PM CT 83 Comments Email Print

Google+

Save

Photographer: Brian Kersey/Getty Images via Bloomberg

Illinois Governor Pat Quinn speaks to supporters at an election night rally in Chicago.

Illinois will have to find a new way to fix the worst pension shortfall in the U.S. after a judge struck down a 2013 law that included raising the retirement age.

Yesterday�s ruling that the pension changes would have violated the state�s constitution undoes a signature achievement of outgoing Democratic Governor Pat Quinn and hands responsibility for tackling the state�s $111 billion pension deficit to Republican businessman Bruce Rauner, who defeated him in the Nov. 4 election.

State constitutions have been invoked elsewhere to try to prevent cuts to public pensions. In Rhode Island, unions settled with the state over pension cuts before their constitutional challenge could be put to the test. In municipal bankruptcy cases in Detroit and California, judges ruled that federal law overrode state bans on cutting pensions.

Illinois Attorney General Lisa Madigan, a Democrat, said she�ll appeal the ruling by Judge John Belz in Springfield and ask the state Supreme Court to fast-track the review.

�Today�s ruling is the first step in a process that should ultimately be decided by the Illinois Supreme Court,� Rauner said yesterday. �It is my hope that the court will take up the case and rule as soon as possible. I look forward to working with the legislature to craft and implement effective, bipartisan pension reform.�

Photographer: John Gress/Getty Images via Bloomberg

Republican businessman Bruce Rauner speaks during his election night gathering in Chicago.

Power Limited

Belz concluded that a 1970 constitutional provision barring cuts to public employee retirement benefits trumps the state�s claim that it has the power to trim future cost-of-living adjustments and delay retirement eligibility for some workers.

�The court finds there is no police power or reserved sovereign power to diminish pension benefits,� he said, voiding the legislation in its entirety and permanently barring the state from enforcing any part of it.

The plan to save about $145 billion over 30 years by reducing those adjustments and raising the retirement age for workers 45 and under was set to take effect on June 1 before being put on hold by a court order in May.

Illinois bonds weakened after the ruling. Taxable pension debt maturing in June 2033, the most frequently traded state securities, traded yesterday after the decision at a yield of 5.32 percent, compared with an average of 5.26 percent yesterday and 5.3 percent this month, according to data compiled by Bloomberg. It�s about 2.7 percentage points more than Treasuries.

Seven States

Seven states have constitutional provisions that protect public worker pensions, said James Spiotto, a bankruptcy specialist and managing director at Chicago�s Chapman Strategic Advisors LLC, which advises creditors on financial restructuring.

State and local governments must confront the rising costs of retirement benefits before they hurt essential services such as police and fire protection, Spiotto said in an e-mail.

�Labor and pension contracts under state constitutions and statutory provisions should not be interpreted as a mutual suicide pact,� Spiotto said. �A recovery plan with reasonable adjustments to pension benefits to what is sustainable and affordable is the only path forward for all concerned.�

Arguments Heard

Public worker unions sued over the legislation in January. Belz heard arguments over the pension reform plan two days ago.

The legislation�s challengers were buoyed in July by a state Supreme Court ruling that Illinois couldn�t cut contributions to government retirees� health insurance premiums, known as other post-employment benefits, or OPEB.

�The market may be a little disappointed,� said Triet Nguyen, a managing director at New York-based NewOak Capital LLC. �Between the OPEB ruling and then this one, the new governor is going to have his hands pretty much tied.�

The health insurance case stands for the proposition that the constitution�s shield �absolutely protects pension benefits from any unilateral diminishment and impairment by the state under any circumstance,� members of the Illinois State Employees Association, the Retired State Employees Association and others suing to overturn the fix said in an August filing.

The state argued that it had been �on track� to pay down its unfunded pension liabilities over the next 40 years as required by 1994 legislation before being derailed by �a series of adverse events,� most significantly the economic downturn that gathered strength in 2007 and 2008 and crested the following year.

Great Recession

�To respond to the severe financial impacts of the Great Recession, the state is fully justified in exercising its reserved sovereign powers to enact modest reductions in future benefit increases for system members,� according to an Oct. 3 filing by Madigan.

We Are One Illinois, a coalition of public employee unions that sued to overturn the law, praised Belz�s decision.

�The Illinois Constitution means what it says,� the group said in a statement yesterday. �The court held today, as our unions have long argued, that the state cannot simply choose to violate the Constitution and diminish or impair retirement benefits if politicians find these commitments inconvenient to keep.�

The case is In re Pension Litigation, 2014-MR-000001, Sangamon County, Illinois, Circuit Court (Springfield).

TRIBUNE EDITORIAL, November 23, 2014

Sangamon County Circuit Judge John Belz has ruled Illinois' pension reform law unconstitutional.

"The Act without question diminishes and impairs the benefits of membership in State retirement systems," he wrote in a firm, six-page ruling released Friday.

And the import of that? Illinois law, Belz wrote, clearly states that "any attempt to diminish or impair pension rights is unconstitutional." He said Illinois courts consistently have held that the protection "is absolute and without exception."

Gov.-elect Bruce Rauner discusses his agenda to move forward on pension reform after a Springfield judge struck down a state pension law. (Zbigniew Bzdak, Chicago Tribune)

Notice the phrase "pension rights." In essence Belz is saying that whatever benefits were in force the first day of a worker's employment are in force until the moment of his or her death.

This first test of Attorney General Lisa Madigan's defense of the December 2013 law � that the state's police powers override the Illinois Constitution's pension protection clause � struck no chord. Belz was wholly unconvinced: "The Court finds as a matter of law that the defendants' affirmative matter provides no legally valid defense," he wrote.

"To dream is to think Illinois can raise enough in taxes to pay for all that." That's really the most significant point that needs to be said constantly. Scheduled pensions benefits will not be paid. Not a chance. If the media and public would finally understand that, they...

This ruling rebuffs backers of pension reform. But it also has a small upside: This state is one day closer to solving a pension crisis that it must solve � a crisis unsustainable and unrivaled in any other state. Madigan will appeal to the Illinois Supreme Court, where lawmakers hope to get some direction on a constitutional solution � and quickly. Madigan will ask that the justices expedite the case.

Of course, a Supreme Court ruling that nixes Belz and upholds the law would be the most prudent decision for taxpayers. But it doesn't look likely the justices will rule that way. In a separate July case, the high court ruled that retiree health care benefits are constitutionally protected, even though they aren't specifically mentioned in the constitution's pension clause. So by extension, pension benefits, including built-in cost-of-living adjustments and early retirement-age promises, may well receive the same protection.

Organized labor cheered Friday's ruling. But is the victory Pyrrhic? Illinois is in a long-range crisis, with some $200 billion in taxpayers' public debts, including $100 billion in unfunded pension obligations. To dream is to think Illinois can raise enough in taxes to pay for all that. Chicago, Cook County, the Chicago Public Schools and other local governments face similar pension crises.

Expect hard times for ... everyone.

Gov.-elect Bruce Rauner, won't sugarcoat what lies ahead for the state. Will this ruling breathe new life into the concept of ending defined benefit plans for new state employees and instead putting them in 401(k)-style plans, as Rauner has proposed? It just might.

Rauner campaigned on the concept of reinventing state government. Changing future retirement benefits would be an awkward place to start, given that many of today's legislators voted for the phenomenally costly benefits sweeteners that are now at issue. They stewed for years on how to fix their mess before they passed a law that now appears headed for the rocks. With Illinois sinking in debt and judges shrugging their shoulders, legislators face some grim decisions. Look out.

By: George N. Schmidt, Editor

Comments must give full name!

We check our site several times a day and always hope there are many many many intelligent comments. However, we have to continue to enforce our rule that those making comments are giving our readers both their first name and last name.

We recently had a very good comment about the Illinois pension "crisis" but the person didn't provide our readers with its full name, so I wrote the following to it:

November 28, 2014

Hello "Kari"

We make it clear to everyone who goes to our "comment" section that we require the person to give us their full name (first name and last name) and an accurate email address. While this dramatically reduces the number of comments we publish, it also saves our readers from the endless trolling that happens on most sites because they allow anonymous comments.

I read and saved your pointed comment on the Illinois pension problems and would love to have it at the top of our site right now, but you will have to provide me with (a) your full name and (b) a phone number so we can reach you in the real world if necessary.

Meanwhile, your comment is invisible. Once we know your full name, it will go back up, gladly.

Solidarity forever,

George N. Schmidt, Editor, Substance