Tribune's expose on variable rate bonds for Chicago Public Schools leaves out facts of history -- Substance and CORE exposed these 'toxic' deals beginning in August 2009, and continued to demand answers as late as the October 2014 Board meeting -- while CPS officials engineered their cover up!

Beginning on November 9, 2014 and continuing on November 10, 2014, the Chicago Tribune (which has returned to its roots as a definitive newspaper following a few embarrassing years when it was owned by real estate mogul Sam Zell) published one of the best and most devastating investigative reports about Chicago Public Schools in history. The two-part series demonstrated how the Board of Education went into variable interest rate on its bonds between 2003 and 2007 in a way that will cost the school system tens of millions of dollars in the years ahead.

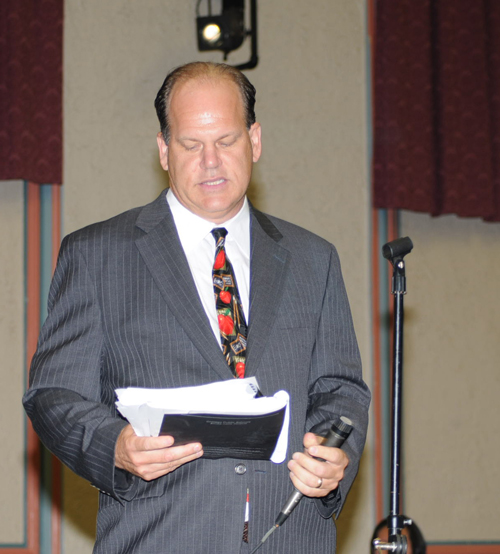

On August 17, 2009, Whitney Young High School teacher Jay Rehak stood before Chicago Board of Education budget officials at the Board's annual budget hearings and asked why CPS was entering into variable rate bond debt. Rehak, shown above during that hearing, was reading from the CAFR, the Board's Comprehensive Annual Financial Report (also called the Comprehensive Audited Financial Report by some), which is the only CPS budget document that reveals the facts of the school system's annual budget. In the 2008 CAFR, which Rehak is holding, Substance and CORE researchers noted a footnote (#10 for those going to the CAFRs now) that revealed that CPS officials had been issuing the variable rate bonds for several years, even though at the time the Rules of the Chicago Board of Education stated that CPS was only supposed to issue fixed-rate debt. Substance photo by George N. Schmidt.One major fact left out of the Tribune reports is that Substance and CORE first exposed these toxic deals in August 2009 during the Board of Education's annual budget hearings. Additionally, Substance, CORE -- and since 2010 the leadership of the Chicago Teachers Union -- have been demanding accountability from the Board on a regular basis because of what the union and Substance have been calling the "toxic swaps."

On August 17, 2009, Whitney Young High School teacher Jay Rehak stood before Chicago Board of Education budget officials at the Board's annual budget hearings and asked why CPS was entering into variable rate bond debt. Rehak, shown above during that hearing, was reading from the CAFR, the Board's Comprehensive Annual Financial Report (also called the Comprehensive Audited Financial Report by some), which is the only CPS budget document that reveals the facts of the school system's annual budget. In the 2008 CAFR, which Rehak is holding, Substance and CORE researchers noted a footnote (#10 for those going to the CAFRs now) that revealed that CPS officials had been issuing the variable rate bonds for several years, even though at the time the Rules of the Chicago Board of Education stated that CPS was only supposed to issue fixed-rate debt. Substance photo by George N. Schmidt.One major fact left out of the Tribune reports is that Substance and CORE first exposed these toxic deals in August 2009 during the Board of Education's annual budget hearings. Additionally, Substance, CORE -- and since 2010 the leadership of the Chicago Teachers Union -- have been demanding accountability from the Board on a regular basis because of what the union and Substance have been calling the "toxic swaps."

While there have been disagreements among the critics who publicly denounced the Board's use of variable rate bonds (as opposed to fixed rate bonds), it was only because some of us (including this reporter) knew that the public schools would take a huge loss if the banks that had agree to the deals agreed to end them under certain terms.

By September 2014, however, researchers (including a former U.S. Congressman) had uncovered the fact that the Board could request "arbitration" to prove the the risks associated with the deals were not disclosed by the banks (as the Tribune has now reported). Once it was clear that CPS could at least arbitrate the deals, the remaining question was why the Board of Education members did not simply go to arbitration. The answer to that became clear after the Tribune expose -- David Vitale, now president of the Board, was behind the deals that are costing the taxpayers of Chicago and the schools millions of dollars while David Vitale and the members of the Board repeatedly claim that the financial problems of CPS are all caused by pension obligations.

The history left out in 2014 by the Tribune began with research by a handful of teachers and others and was mainly led by Substance until CORE members were elected to lead the CTU in June 2010.

On August 17, 2009, CORE researchers challenged the Board to explain why it had been entering into variable rate bond deals since 2003. The deals were revealed in a brief footnote in the Board's "Comprehensive Annual Financial Report", or CAFR, which Substance and leaders of the newly formed Chicago Teachers Union caucus called CORE (Caucus Of Rank-and-file Educators) had been studying for a year. (Substance researchers had been studying the CPS budgets since 1980, long before CORE was founded, and brought budget expertise to the new and energetic caucus).

The CORE challenge over the variable rate bond deals began at Amundsen High School on August 17, 2009. There, during the budget hearings, Jay Rehak, a teacher at Whitney Young High School and part of the budget study team of CORE and Substance, stood before the Board budget officials and demanded to know why the Board was entering into these dangerous deals. There was no answer, and the budget people said they would get back to the speaker the following day.

CPS Treasurer (at the time) David Bryant (right above) speaks during the August 18, 2009 budget hearings at Marshall High School while Whitney Young High School teacher Jar Rehak (standing, left) looks one. In the foreground is CORE activist Al Ramirez, who videotaped the hearings that summer for CORE and Substance. Substance photo by George N. Schmidt.On August 18, 2009, the budget hearings were held at Marshall High School, and Jay Rehak and this reporter arrived to be greeted by a well dressed many whom we had never met. He introduced himself as David Bryant, said he was treasurer of the Board, and wanted to explain the whole thing to us on the side (and clearly off the record). After politely explaining how Bryant should instead make his explanation public, Rehak took the microphone when he was called on to speak, reminded the Board he had asked bout the variable rate bond deals, and then said that Bryant could provide more answers than any of us. Bryant took the microphone, reluctantly, and tried to dodge any serious questions, as the transcript records show.

CPS Treasurer (at the time) David Bryant (right above) speaks during the August 18, 2009 budget hearings at Marshall High School while Whitney Young High School teacher Jar Rehak (standing, left) looks one. In the foreground is CORE activist Al Ramirez, who videotaped the hearings that summer for CORE and Substance. Substance photo by George N. Schmidt.On August 18, 2009, the budget hearings were held at Marshall High School, and Jay Rehak and this reporter arrived to be greeted by a well dressed many whom we had never met. He introduced himself as David Bryant, said he was treasurer of the Board, and wanted to explain the whole thing to us on the side (and clearly off the record). After politely explaining how Bryant should instead make his explanation public, Rehak took the microphone when he was called on to speak, reminded the Board he had asked bout the variable rate bond deals, and then said that Bryant could provide more answers than any of us. Bryant took the microphone, reluctantly, and tried to dodge any serious questions, as the transcript records show.

The hearings concluded at Black Magnet Elementary School on August 19, when the bond costs were again challenged and CPS budget officials promised to get back to everyone about the concerns.

But the question soon became "Which CPS budget officials?" By the end of the term of Arne Duncan as CPS CEO, David Vitale was no longer "CAO" of CPS, but during Arne's early years, Vitale had gone from being a "dollar a year guy" (supposedly doing the work for the public good at no salary) to being one of the highest paid officials at the Chicago Public Schools. The Chicago Sun-Times, which had oozed admiration for Vitale when he first appeared at CPS and announced he didn't need to be paid, didn't notice that his office (which doesn't exist in most corporations) perpetuated itself, and his salary became one of the top five in the supposedly cash-strapped public school system. This year, Vitale's most recent successor, former Motorola executive Tim Cawley, is being paid $215,000 per year as "Chief Administrative Officer" of CPS, while the school system's "Chief Financial Officer" is excluded by the Board of Education from its monthly meetings (as the CFO has been for several years). Whenever financial or contractual issues are before the Board, it is the "CAO" -- not the CFO -- who takes the floor to answer well-rehearsed and carefully scripted questions.

Since David Vitale slowly became the dominant power in America's third largest school system, the school board has churned its other top people.

-- There have been at least five treasurers since 2003, when the variable rate borrowings began.

Despite the fact that he had no teaching experience and no credentials to teach or supervise in any school district in Illinois, under corporate school reform, Arne Duncan was "qualified" to be the Chief Executive Officer of Chicago's public schools beginning in July 2003. Duncan was CEO during the years when, with his recommendation, the Chicago Board of Education entered into a series of risky and potentially expensive variable rate bond deals. Above, Duncan at the April 26, 2006 meeting of the Chicago Board of Education. Duncan served as CPS CEO from July 2001 through December 2008, when President Barack Obama appointed Duncan to become U.S. Secretary of Education, the position he still holds. Substance photo by George N. Schmidt.-- Since August 2003, CPS has had five (or six, depending upon whether you count the "interim" one) Chief Executive Officers. In 2003, Arne Duncan was CEO. In January 2009, ex-cop Ron Huberman became CEO. In 2011, Terry Mazany became "Interim CEO." In May 2011, Jean-Claude Brizard was appointed CEO by the new mayor, Rahm Emanuel. After Brizard messed up during the Chicago Teachers Strike of 2012 (September 2012), Brizard was replaced by Barbara Byrd Bennett. Brizard had been brought to head the Chicago school system after a tumultuous time as superintendent in Rochester, New York. Byrd Bennett came to Chicago after a sting in Detroit.

Despite the fact that he had no teaching experience and no credentials to teach or supervise in any school district in Illinois, under corporate school reform, Arne Duncan was "qualified" to be the Chief Executive Officer of Chicago's public schools beginning in July 2003. Duncan was CEO during the years when, with his recommendation, the Chicago Board of Education entered into a series of risky and potentially expensive variable rate bond deals. Above, Duncan at the April 26, 2006 meeting of the Chicago Board of Education. Duncan served as CPS CEO from July 2001 through December 2008, when President Barack Obama appointed Duncan to become U.S. Secretary of Education, the position he still holds. Substance photo by George N. Schmidt.-- Since August 2003, CPS has had five (or six, depending upon whether you count the "interim" one) Chief Executive Officers. In 2003, Arne Duncan was CEO. In January 2009, ex-cop Ron Huberman became CEO. In 2011, Terry Mazany became "Interim CEO." In May 2011, Jean-Claude Brizard was appointed CEO by the new mayor, Rahm Emanuel. After Brizard messed up during the Chicago Teachers Strike of 2012 (September 2012), Brizard was replaced by Barbara Byrd Bennett. Brizard had been brought to head the Chicago school system after a tumultuous time as superintendent in Rochester, New York. Byrd Bennett came to Chicago after a sting in Detroit.

The top financial officers of Chicago Public Schools in 2006, halfway through the variable rate bond dealings, were Pedro Martinez (left), who at the time held the title "Budget Director", and John Maiorca (right) who was the system's "Chief Financial Officer." Mairoca was followed as CFO by Martinez, who had come to CPS from City Hall (Martinez is not a superintendent of schools in Washoe County Nevada despite the fact that like some others out of Chicago, he never taught or served as a principal anywhere). Martinez was followed by (so far) three successive CFOs. By 2011, the discussions of budgetary matters were being handled by the "CAO", and the CFOs were not even present during the meetings of the Chicago Board of Education. The photo here was taken during the April 26, 2006 meeting of the Chicago Board of Education. Substance photo by George N. Schmidt.-- Since August 2003, CPS has had five or six Chief Financial Officers.

The top financial officers of Chicago Public Schools in 2006, halfway through the variable rate bond dealings, were Pedro Martinez (left), who at the time held the title "Budget Director", and John Maiorca (right) who was the system's "Chief Financial Officer." Mairoca was followed as CFO by Martinez, who had come to CPS from City Hall (Martinez is not a superintendent of schools in Washoe County Nevada despite the fact that like some others out of Chicago, he never taught or served as a principal anywhere). Martinez was followed by (so far) three successive CFOs. By 2011, the discussions of budgetary matters were being handled by the "CAO", and the CFOs were not even present during the meetings of the Chicago Board of Education. The photo here was taken during the April 26, 2006 meeting of the Chicago Board of Education. Substance photo by George N. Schmidt.-- Since August 2003, CPS has had five or six Chief Financial Officers.

And other financial officials have also come and gone at a faster rate than the city's substitute teachers. Because of that, the school system has carefully eliminated its institutional memory, so that when serious questions are asked about expensive financial deals such as the variable rate bonds, there is no one in the top financial offices to answer questions. The school system is reduced to talking points -- and to bullying speakers when important questions are raised in public, as they have been at the last two meetings of the Chicago Board of Education.

During the years of massive risky borrowing now exposed fully by the Chicago Tribune, the Board of Education never discussed such financial matters in public during its brief monthly public meetings. And every six months, the Board has destroyed or relegated to "secret" the discussions they have held during executive sessions, which are permitted by the Open Meetings Act. The two lawyers on the Board (Zopp and Ruiz) have cheerfully lent their votes to each of these questionable procedures, helping to ensure that the cover up of CPS financial misdeeds is complete and done in accordance with a law that allowed school boards to maintain the secrecy of their closed sessions even if nothing is really discussed at the open meetings.

Comments:

By: Valerie F. Leonard

Co-Founder. Lawndale Alliance

Once again, the Chicago Board of Education has abdicated its fiduciary responsibility. These conflicts of interest are destroying our school district, and Board members who know better continue to go along like lemmings. We need an elected board of education that will be accountable to the people and uphold the public trust.

By: dave vance

high interest toxic loans

Yes, public groups and the CTU have been speaking out and protesting the expensive deal David Vitale made with our public money. Substance News has reported statements made to the Board demanding they renegotiate the risky loans going back 5 years.

I remember Jackson Potter a year ago telling David Vitale, �Yes, you can do it.� You can demand the banks renegotiate the loans made to CPS.� Potter was explaining that our schools need the money not the banks who are making excessive profits on the high interest that CPS is paying them.

And, recently in September, Labor Beat covered a protest at Loop Capital an investment company that is making huge money from the Vitale interest rate swap deal.

Dave Vance

"Loop Capital Swaps Rip Off Chicago Schools"

Published on Sep 22, 2014

http://youtu.be/46gRPVpYdpw

Friday, Sept. 19, 2014. Chicago Teachers Union members and retirees from AFSCME Council 31 and SEIU Healthcare Illinois marched in front of the Chicago headquarters of Loop Capital, a private investment firm run by one of Mayor Emanuel's pals. Loop Capital, according to the CTU, has extracted "through risky interest rate swap deals" over $100 million yearly from the city's public schools.

By: Jay Rehak

Couldn't have done it without Substance.

Hats off to Substance for covering those hearings and for being diligent in its review of the budgets. George Schmidt was/is relentless when it comes to reviewing CPS budgets, and it was though George's efforts, as well as Kurt Hilgendorf and others that we were able to begin the process of some accountability for these toxic instruments being in the CPS portfolio. I think it is very important to note that although CPS (and by extension the children of Chicago) lost huge sums of money on "bad bets" many on Wall Street profited from CPS's short sighted gamble.

It is also important to note that those losses will continue into the future. The bleeding has not stopped. We need to keep the pressure on and insist CPS continue to "come clean" on not only past losses but also future liabilities due to these opaque financial instruments in their financial portfolio.

Again, this story is, sadly, not over. Many more millions of dollars are certain to be lost as a consequence of the reckless behavior of CPS individuals.

The citizens of Chicago should now all be screaming from the hustings for an ELECTED SCHOOL BOARD. It's way past time for honest and full accountability in the school system.