MEDIA WATCH: Bloomberg Business Week magazine recommends the ruling class read Karl Marx

One of the facts that the classical economists knew from the beginning (Adam Smith) was that somewhere the ruling class, at every stage in history, kept the information it needed to rule and profit. The capitalist phase of history has just expanded that information flow, and from the beginning the most successful capitalists were not merely the most aggressive (and sometimes ruthless; never the "smartest," by the way because of their narrow visions, always constrained by profit and accumulation) but those who were most informed. "Data driven management" was virtually invented with the dawn of capitalism and has been in place ever since. (The prior era might be called "superstition driven management" — think bishops, priests, and Popes; the two are incompatible).

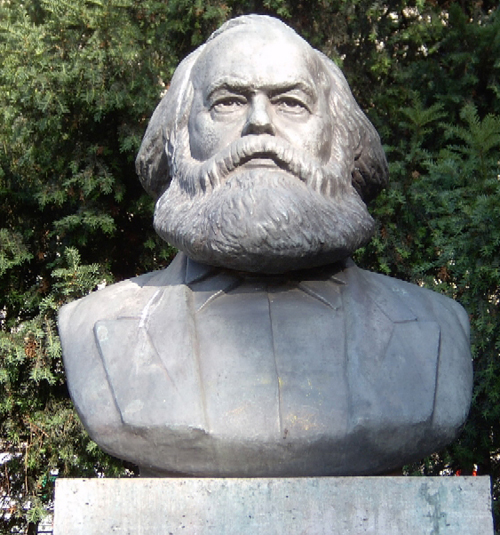

Karl Marx in London, where he did most of his study of how capitalism functioned during its industrial phase.This is a lengthy way of saying that when capitalism faces one of its routine crises (they used to be called "panics", which was superseded by "depressions," which are now downgraded linguistically to "Great Recessions" which are always being fended off), they pay attention to the facts, even if they don't share them with the unwashed and untutored masses.

Karl Marx in London, where he did most of his study of how capitalism functioned during its industrial phase.This is a lengthy way of saying that when capitalism faces one of its routine crises (they used to be called "panics", which was superseded by "depressions," which are now downgraded linguistically to "Great Recessions" which are always being fended off), they pay attention to the facts, even if they don't share them with the unwashed and untutored masses.

One of those facts is that since the dawn of capitalism, the so-called "business cycle" has been a part of the system. The morons of capitalist theory over the past quarter century (and this includes most famously Alan Greenspan, and other Ayn Rand zealots) actually convinced themselves that the periodic "crises" of the capitalist business cycle had been eliminated (this time, it was by the latest iteration of "globalization" and the so-called "information age").

Then capitalist history repeated itself, again, then again, then again, first with crises primarily outside the USA, then with two home-grown ones since the dawn of the 21st Century.

As a result, the press the capitalists themselves read (like "Bloomberg Business Week") are starting to pay attention to the facts and less to the nonsensical prognostications of guys like Greenspan.

So, in the September 19, 2011 issue of "Bloomberg Business Week" we have a tribute to Karl Marx and a suggestion that capitalists today read him and take seriously some of the stuff he was describing in the capitalist system.

Here it is:

Marx to Market. The economic crisis has made the philosopher’s ideas relevant again, but the world shouldn’t forget what Marx got wrong. By Peter Coy. THIS WEEK. September 19, 2011

America Isn't Working

Society generally moves on from its mistakes. Doctors no longer drain blood from patients. Aviators don’t try to fly by strapping wings to their arms. Nobody still thinks that slavery is a good idea. Karl Marx, though, appears to be an exception to the rule of live and learn. Marx’s most famous predictions failed; there has been no dictatorship of the proletariat, nor has the state withered away. His followers included some of the 20th century’s worst mass murderers: Lenin, Stalin, Mao, Pol Pot. Yet the gloomy, combative philosopher seems to find adherents in each new generation of tyrants and dreamers.

You might even say the Bearded One has rarely looked better. The current global financial crisis has given rise to a new contingent of unlikely admirers. In 2009 the Vatican’s official newspaper, L’Osservatore Romano, published an article praising Marx’s diagnosis of income inequality, which is quite an endorsement considering that Marx declared religion to be “the opium of the people.” In Shanghai, the turbo-capitalist hub of Communist-in-name-alone China, audiences flocked to a 2010 musical based on Capital, Marx’s most famous work. In Japan, Capital is now out in a manga version. Brazilians elected a former Marxist guerrilla, Dilma Rousseff, as President last year.

The vogue for Marx should be expected at a time when European banks stand on the precipice of collapse and poverty levels in the U.S. have reached levels not seen in nearly two decades. Politicians know they can score points with their constituents by kicking job-creating capitalists like mangy curs.

Here’s the surprising thing, though: You don’t have to sleep in a Che Guevara T-shirt or throw rocks at McDonald’s to acknowledge that Marx’s thought is worth studying, grappling with, and possibly even applying to our current challenges. Many of the great capitalist thinkers did so, after all. Joseph Schumpeter, the guru of “creative destruction” who is a hero to many free-marketeers, devoted the first four chapters of his 1942 book, Capitalism, Socialism and Democracy, to explorations of Marx the Prophet, Marx the Sociologist, Marx the Economist, and Marx the Teacher. He went on to say Marx was wrong, but he couldn’t ignore the man.

As misguided as Marx was about many things, and as pernicious as his influence was in places like the U.S.S.R. and China, there are pieces of his (voluminous) writings that are shockingly perceptive. One of Marx’s most important contentions was that capitalism was inherently unstable. One only has to look at the headlines out of Europe—which is haunted by the specter of a possible Greek default, a banking disaster, and the collapse of the single-currency euro zone—to see that he was right. Marx diagnosed capitalism’s instability at a time when his contemporaries and predecessors, such as Adam Smith and John Stuart Mill, were mostly enthralled by its ability to serve human wants.

Marx has gotten an attentive reading recently from the likes of New York University economist Nouriel Roubini and George Magnus, the London-based senior economic adviser to UBS Investment Bank. Magnus’s employer, Switzerland-based UBS, is a pillar of the financial establishment, with offices in more than 50 countries and over $2 trillion in assets. Yet in an Aug. 28 essay for Bloomberg View, Magnus wrote that “today’s global economy bears some uncanny resemblances” to what Marx foresaw. (Personal opinion only, he noted.)

Consider the particulars. As Magnus notes, Marx predicted that companies would need fewer workers as they improved productivity, creating an “industrial reserve army” of the unemployed whose existence would keep downward pressure on wages for the employed. It’s hard to argue with that these days, given that the U.S. unemployment rate is still more than 9 percent. On Sept. 13 the U.S. Census Bureau released data showing that median income fell from 1973 through 2010 for full-time, year-round male workers aged 15 and up, adjusted for inflation. The condition of blue-collar workers in the U.S. is still a far cry from the subsistence wage and “accumulation of misery” that Marx conjured. But it’s not morning in America, either.

Marx loved to bash French economist Jean-Baptiste Say, who argued that general gluts cannot exist because the market will always match supply and demand. Marx argued that overproduction was in fact endemic to capitalism because the proletariat isn’t paid enough to buy the stuff that the capitalists produce. Again, that theory has lately been hard to dispute. The only way blue-collar Americans managed to maintain consumption in the last decade was by overborrowing. When the housing market collapsed, many were left with crippling debt. The resulting default nightmare is still playing itself out.

Admirers of Marx view all this with a rueful I-told-you-so. The radical geographer David Harvey, 75, has taught Marx’s Capital for 40 years at schools including Oxford University, Johns Hopkins University, and now the City University of New York Graduate Center. Harvey’s office, a block from the Empire State Building, is decorated with a silk-screen portrait of Marx, glowering from a bookcase. Harvey believes, as Marx did, that capitalists tend to sow the seeds of their own destruction. Unbridled capitalism tends toward wild excess, so complete deregulation is actually disastrous for it in the long run, the professor argues. “The Republican Party is en route to destroy capitalism,” Harvey says in a pleasant tone, “and they may do a better job of it than the working class could.”

But wait. What Marx and his acolytes underappreciated was capitalism’s power to heal itself. It may have been his fatal intellectual mistake. The Communist Manifesto said that when the workers’ revolution came, it would bring free public education for children and the abolition of “children’s factory labor in its present form.” And yet, as it turned out, the world didn’t require a proletarian revolution for those social reforms to occur; all it took was enlightened capitalism.

Doctrinaire Marxists love to say that the economic “base” determines and controls the sociopolitical “superstructure,” but the reverse can be true as well. Political leaders have corrected capitalism’s excesses again and again, as in President Teddy Roosevelt’s trustbusting campaign, President Franklin Roosevelt’s New Deal, and President Lyndon Johnson’s Great Society.

Now, once again, unbridled capitalism is threatening to undermine itself. The world’s biggest banks, financially weak but politically powerful, are putting the screws on borrowers in an attempt to rescue their own balance sheets. Likewise, creditor nations such as China and Germany are attempting to shift the pain of rebalancing onto debtor nations, even though squeezing them too hard threatens to cause an economic and financial disaster.

It’s time for another burst of enlightenment. In years past, Britain’s John Maynard Keynes and America’s Hyman P. Minsky (author of Stabilizing an Unstable Economy) did capitalism a service by diagnosing its tendency toward crisis and advising on ways to make things better. The sooner policymakers today “recognize we’re facing a once-in-a-lifetime crisis of capitalism,” as Magnus writes, “the better equipped they will be to manage a way out of it.” Grasping the ways in which Marx was right is the first step toward making sure that his predictions of capitalism’s downfall remain wrong.

Coy is Bloomberg Businessweek's Economics editor.

Comments:

By: Jim Vail

Capitalism

This Business Week writer says "What Marx and his acolytes underappreciated was capitalism’s power to heal itself. ... And yet, as it turned out, the world didn’t require a proletarian revolution for those social reforms to occur; all it took was enlightened capitalism."

What is "enlighted capitalism?" The New Deal that brought social security, medicare, wage laws, brilliant anti-speculative regulations, union protections, etc., was a result of the US ruling class being scared shitless after the Bolsheviks took control of an empire, and their comrades were pounding the streets in Uncle Sam's land demanding similar worker concessions during our depression.

Englighted capitalism? Or pure survival tactics to ensure their billions are not totally lost. Now they want it back, all of it.

It's a class war baby as Marx wrote, whether you like it or not.

By: Nathan Goldbaum

Marx was right.

Marx is not only right when capitalist economies hit crisis, but he explains its great ability to expand. He also explains why the drive for profit becomes ever more intense, as it gets harder and harder to squeeze higher rates of profit from investment. Think AYP for Wall Street. :-)

Here is a similar article by our friend, Lee Sustar.

http://socialistworker.org/2011/09/13/why-karl-marx-was-right